Instructions For Form 709 - United States Gift (And Generation-Skipping Transfer) Tax Return - 2000

ADVERTISEMENT

2 0 00

Department of the Treasury

Internal Revenue Service

Instructions for Form 709

United States Gift (and Generation-Skipping Transfer)

Tax Return

(For gifts made during calendar year 2000.)

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 11

of the instructions.

Section references are to the Internal Revenue Code unless otherwise noted.

If you are filing this form solely to elect

instructions on pages that would

gift tax is in addition to any other tax, such

gift-splitting for gifts of not more than

otherwise be blank. You can help bring

as Federal income tax, paid or due on the

$20,000 per donee, you may be able to

these children home by looking at the

transfer.

use Form 709–A, United States Short

photographs and calling

The exercise or release of a general

Form Gift Tax Return, instead of this form.

1-800-THE-LOST (1-800-843-5678) if you

power of appointment may be a gift by the

See Who Must File on page 3 and When

recognize a child.

individual possessing the power. General

the Consenting Spouse Must Also File

powers of appointment are those in which

General Instructions

a Gift Tax Return beginning on page 5.

the holders of the power can appoint the

property subject to the power to

Note: If you meet all of the following

themselves, their creditors, their estates,

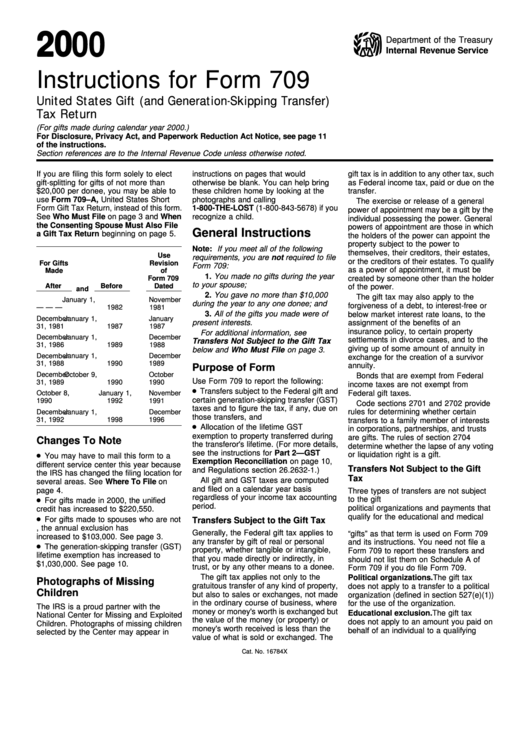

Use

requirements, you are not required to file

or the creditors of their estates. To qualify

For Gifts

Revision

Form 709:

as a power of appointment, it must be

Made

of

1. You made no gifts during the year

Form 709

created by someone other than the holder

to your spouse;

After

Before

Dated

of the power.

and

2. You gave no more than $10,000

The gift tax may also apply to the

January 1,

November

during the year to any one donee; and

forgiveness of a debt, to interest-free or

— — —

1982

1981

3. All of the gifts you made were of

below market interest rate loans, to the

December

January 1,

January

present interests.

assignment of the benefits of an

31, 1981

1987

1987

insurance policy, to certain property

For additional information, see

December

January 1,

December

settlements in divorce cases, and to the

Transfers Not Subject to the Gift Tax

31, 1986

1989

1988

giving up of some amount of annuity in

below and Who Must File on page 3.

December

January 1,

December

exchange for the creation of a survivor

31, 1988

1990

1989

annuity.

Purpose of Form

December

October 9,

October

Bonds that are exempt from Federal

Use Form 709 to report the following:

31, 1989

1990

1990

income taxes are not exempt from

Transfers subject to the Federal gift and

Federal gift taxes.

October 8,

January 1,

November

certain generation-skipping transfer (GST)

1990

1992

1991

Code sections 2701 and 2702 provide

taxes and to figure the tax, if any, due on

rules for determining whether certain

December

January 1,

December

those transfers, and

31, 1992

1998

1996

transfers to a family member of interests

Allocation of the lifetime GST

in corporations, partnerships, and trusts

exemption to property transferred during

are gifts. The rules of section 2704

Changes To Note

the transferor's lifetime. (For more details,

determine whether the lapse of any voting

see the instructions for Part 2—GST

or liquidation right is a gift.

You may have to mail this form to a

Exemption Reconciliation on page 10,

different service center this year because

Transfers Not Subject to the Gift

and Regulations section 26.2632-1.)

the IRS has changed the filing location for

Tax

All gift and GST taxes are computed

several areas. See Where To File on

and filed on a calendar year basis

page 4.

Three types of transfers are not subject

regardless of your income tax accounting

to the gift tax. These are transfers to

For gifts made in 2000, the unified

period.

political organizations and payments that

credit has increased to $220,550.

qualify for the educational and medical

For gifts made to spouses who are not

Transfers Subject to the Gift Tax

exclusions. These transfers are not

U.S. citizens, the annual exclusion has

Generally, the Federal gift tax applies to

“gifts” as that term is used on Form 709

increased to $103,000. See page 3.

any transfer by gift of real or personal

and its instructions. You need not file a

The generation-skipping transfer (GST)

property, whether tangible or intangible,

Form 709 to report these transfers and

lifetime exemption has increased to

that you made directly or indirectly, in

should not list them on Schedule A of

$1,030,000. See page 10.

trust, or by any other means to a donee.

Form 709 if you do file Form 709.

The gift tax applies not only to the

Political organizations. The gift tax

Photographs of Missing

gratuitous transfer of any kind of property,

does not apply to a transfer to a political

Children

but also to sales or exchanges, not made

organization (defined in section 527(e)(1))

in the ordinary course of business, where

for the use of the organization.

The IRS is a proud partner with the

money or money's worth is exchanged but

Educational exclusion. The gift tax

National Center for Missing and Exploited

the value of the money (or property) or

does not apply to an amount you paid on

Children. Photographs of missing children

money's worth received is less than the

behalf of an individual to a qualifying

selected by the Center may appear in

value of what is sold or exchanged. The

Cat. No. 16784X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12