Instructions For Form 709 - United States Gift (And Generation-Skipping Transfer) Tax Return - 2017

ADVERTISEMENT

2017

Department of the Treasury

Internal Revenue Service

Instructions for Form 709

United States Gift (and Generation-Skipping Transfer) Tax Return

For gifts made during calendar year 2017

estate must have elected on a timely and

taxes and to figure the tax due, if any, on

Section references are to the Internal Revenue

Code unless otherwise noted.

complete Form 706 to allow the donor to

those transfers.

use the predeceased spouse's unused

Allocation of the lifetime GST

Future Developments

exclusion amount.

exemption to property transferred during

the transferor's lifetime. (For more details,

Same-sex marriage. For federal tax

For the latest information about

see Schedule D, Part 2—GST Exemption

purposes, marriages of couples of the

developments related to Form 709 and its

Reconciliation, later, and Regulations

same sex are treated the same as

instructions, such as legislation enacted

section 26.2632-1.)

marriages of couples of the opposite sex.

after they were published, go to

IRS.gov/

The term “spouse” includes an individual

All gift and GST taxes must be

Form709.

married to a person of the same sex.

computed and filed on a calendar

!

However, individuals who have entered

year basis. List all reportable gifts

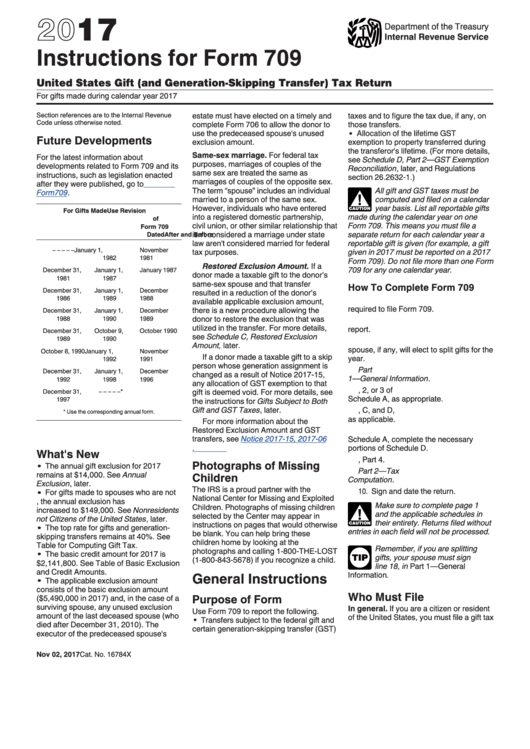

For Gifts Made

Use Revision

CAUTION

into a registered domestic partnership,

made during the calendar year on one

of

civil union, or other similar relationship that

Form 709. This means you must file a

Form 709

isn't considered a marriage under state

separate return for each calendar year a

After

and Before

Dated

law aren't considered married for federal

reportable gift is given (for example, a gift

– – – – –

January 1,

November

tax purposes.

given in 2017 must be reported on a 2017

1982

1981

Form 709). Do not file more than one Form

Restored Exclusion Amount. If a

709 for any one calendar year.

December 31,

January 1,

January 1987

donor made a taxable gift to the donor’s

1981

1987

same-sex spouse and that transfer

How To Complete Form 709

December 31,

January 1,

December

resulted in a reduction of the donor’s

1986

1989

1988

1. Determine whether you are

available applicable exclusion amount,

required to file Form 709.

there is a new procedure allowing the

December 31,

January 1,

December

donor to restore the exclusion that was

1988

1990

1989

2. Determine what gifts you must

utilized in the transfer. For more details,

report.

December 31,

October 9,

October 1990

see Schedule C, Restored Exclusion

1989

1990

3. Decide whether you and your

Amount, later.

spouse, if any, will elect to split gifts for the

October 8, 1990

January 1,

November

If a donor made a taxable gift to a skip

year.

1992

1991

person whose generation assignment is

4. Complete lines 1 through 19 of Part

December 31,

January 1,

December

changed as a result of Notice 2017-15,

1—General Information.

1992

1998

1996

any allocation of GST exemption to that

5. List each gift on Part 1, 2, or 3 of

gift is deemed void. For more details, see

December 31,

– – – – –

*

Schedule A, as appropriate.

1997

the instructions for Gifts Subject to Both

Gift and GST Taxes, later.

6. Complete Schedules B, C, and D,

* Use the corresponding annual form.

as applicable.

For more information about the

Restored Exclusion Amount and GST

7. If the gift was listed on Part 2 or 3 of

transfers, see

Notice 2017-15, 2017-06

Schedule A, complete the necessary

I.R.B.

783.

portions of Schedule D.

What's New

8. Complete Schedule A, Part 4.

Photographs of Missing

The annual gift exclusion for 2017

9. Complete Part 2—Tax

remains at $14,000. See Annual

Children

Computation.

Exclusion, later.

The IRS is a proud partner with the

10. Sign and date the return.

For gifts made to spouses who are not

National Center for Missing and Exploited

U.S. citizens, the annual exclusion has

Make sure to complete page 1

Children. Photographs of missing children

increased to $149,000. See Nonresidents

and the applicable schedules in

!

selected by the Center may appear in

not Citizens of the United States, later.

their entirety. Returns filed without

instructions on pages that would otherwise

The top rate for gifts and generation-

CAUTION

entries in each field will not be processed.

be blank. You can help bring these

skipping transfers remains at 40%. See

children home by looking at the

Table for Computing Gift Tax.

Remember, if you are splitting

photographs and calling 1-800-THE-LOST

The basic credit amount for 2017 is

gifts, your spouse must sign

(1-800-843-5678) if you recognize a child.

TIP

$2,141,800. See Table of Basic Exclusion

line 18, in Part 1—General

and Credit Amounts.

General Instructions

Information.

The applicable exclusion amount

consists of the basic exclusion amount

Who Must File

Purpose of Form

($5,490,000 in 2017) and, in the case of a

surviving spouse, any unused exclusion

In general. If you are a citizen or resident

Use Form 709 to report the following.

amount of the last deceased spouse (who

of the United States, you must file a gift tax

Transfers subject to the federal gift and

died after December 31, 2010). The

certain generation-skipping transfer (GST)

executor of the predeceased spouse's

Nov 02, 2017

Cat. No. 16784X

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20