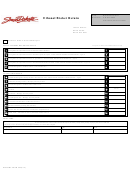

Dor/dmv Form 573 - Marketer Refund Page 2

ADVERTISEMENT

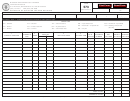

Reefer Storage Diesel Fuel Worksheet

On the worksheet below, list the gallons of reefer fuel sold for each date and indicate

the amount of sales tax you reported and remitted on your previous sales tax return.

Your total gallons for sales tax remitted should equal the amount recorded

on Line 5 on the first page of this refund form.

Record your sales tax license number here:

1

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

2

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

3

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

4

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

5

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

6

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

7

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

8

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

9

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

10

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

11

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

12

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

13

Gallons Undyed Diesel Fuel:

Sales Tax Remitted: $

Date (MM-YY):

Total

Total Gallons Undyed Diesel Fuel:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2