4. TAX LIABILITY NOTICE (Carefully read before completing Item 5.)

Upon the reissuance of savings bonds to a trust, you must include in your gross income any accumulated interest on the bonds,

including any tax-deferred increment noted on Series HH bonds, if you have not already reported it, unless, under the grantor trust

provisions of the Internal Revenue Code, you are treated as the owner of the portion of the trust represented by any tax-deferred

accumulated interest on the reissued bonds. If you are treated as the owner of that portion, the accumulated interest continues to be

your income rather than that of the trust, and therefore, you may continue to defer reporting the interest earned each year. You must

include the total accumulated interest in your gross income when the bonds are disposed of or finally mature, whichever is earlier.

These rules apply if two conditions exist: 1) you are the owner of the portion of the trust represented by the tax-deferred accumulated

interest, and 2) the bonds being reissued are either a) Series I bonds, b) Series EE bonds, or c) Series HH bonds you received in

exchange for either Series EE bonds or Series E bonds or savings notes.

Generally, you will be treated as the owner of a trust that you have created to the extent that you retain certain powers over or

interests in the trust. For example, you will be treated as the owner of the portion of the trust represented by any tax-deferred

accumulated interest on the reissued bonds under the following circumstances:

(1) You will be treated as the owner of a trust to the extent that you have an unconditional power to revest in yourself title to the

trust assets. Thus, if you can, at your discretion, revoke all or part of the trust so that the bonds will be returned to you, you

will be treated as the owner of the portion of the trust represented by any accumulated interest on the bonds.

(2) If the trust instrument provides that the reissued bonds or the proceeds from the redemption or disposition of those bonds

must be distributed to you or your spouse, or held or accumulated for future distribution to you or your spouse, you will be

treated as the owner of the portion of the trust represented by any accumulated interest on the bonds. You will be treated

as the owner in this circumstance irrespective of the terms of the trust.

(3) You will be treated as the owner of a trust to the extent that you retain a power to control the beneficial enjoyment of

property transferred to a trust. Thus, if you retain, under the terms of the trust instrument, an immediately exercisable

power to determine, in your sole discretion, who will receive the bonds or the proceeds from the redemption or disposition of

the bonds, then you will be treated as the owner of the portion of the trust represented by any accumulated interest.

The examples outlined above are illustrative only and they are not intended to cover all possible situations in which you could be

treated as the owner of a trust or a portion of a trust. Furthermore, events can occur, such as the renunciation of a retained power or

interest, which would cause you to cease being treated as the owner of a trust. If you are not sure whether you will be treated as the

owner of a trust, you may request a letter ruling from the Internal Revenue Service. A request for a letter ruling should be sent to:

Internal Revenue Service, ATTN: CC: DOM: CORP: T, P.O. Box 7604, Ben Franklin Station, Washington, DC 20044.

If you have questions concerning the information to be submitted in connection with a letter ruling request, you may call

202-317-4782.

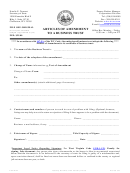

5. TAX LIABILITY STATEMENT (This section must be completed.)

You must check box "a" or "b." (See “TAX LIABILITY NOTICE” above.)

“Interest” includes tax-deferred interest represented by tax legends on Series HH bonds as well as interest earned on Series

EE or Series I bonds from the issue date until the date of reissue.

This statement will also apply to all future transactions requested by the same owner(s) or person(s) entitled to the same

trust.

For Federal income tax purposes:

a.

I certify that I will be treated as owner of the portion of the trust represented by the tax-deferred accumulated

interest on the bonds being reissued. If this box is marked, the interest will be tax-deferred (interest will not

be reported to the Internal Revenue Service as a result of the reissue).

b.

I certify that I will not be treated as owner of the portion of the trust represented by the tax-deferred

accumulated interest on the bonds being reissued. If this box is marked, interest will be reported to the

Internal Revenue Service for the taxable year in which the bonds were reissued to the trust. A 1099-INT will be

generated for the Social Security Number specified.

If "b" is checked and the bonds are in coownership form (e.g., “John Smith OR Jane Smith”), complete the following:

(Name of principal coowner)

(Social Security Number)

is the principal coowner of any bonds registered in coownership form submitted. He or she is responsible for any tax

liability resulting from the reissue transaction requested. (A principal coowner is a coowner who (1) purchased the

bonds with his or her own funds or (2) received them as a gift, inheritance or legacy, or as a result of judicial

proceedings, and has them reissued in coownership form, provided he or she has received no contribution in money

or money’s worth for designating the other person as coowner on the bonds.

The interest will be reported to the Internal Revenue Service, and a 1099-INT will be generated for the Social Security Number

specified above.

FS Form 1851

Department of the Treasury | Bureau of the Fiscal Service

2

1

1 2

2 3

3 4

4 5

5