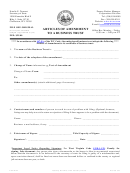

ITEM 1. DESCRIPTION OF BONDS – Fill in the total face amount of the bonds for which reissue is being requested. Fully describe the bonds in

their present form of registration. For Issue Date, enter two digits for the month and two digits for the year.

ITEM 2. TRUST INFORMATION – Provide the Taxpayer Identification Number assigned to the trust, the name of the grantor, the name of the

trustee, the date the trust was created, and the name of any beneficiary of the trust (if the trust is an FBO trust). If more than one grantor or trustee,

list all. This information will be used to ensure that the new bond inscription contains all appropriate information required by the governing

regulations.

ITEM 3. NEW BOND INSCRIPTION

•

Provide the Social Security Number or Employer Identification Number assigned to the trust.

•

For “Registration,” show the name of the trustee, the name of the grantor, and the date the trust was created. If more than one trustee or

grantor, list all. Show the name of any beneficiary(ies) of the trust (if the trust is an FBO trust). (Sample Registrations: “Tenth National Bank,

trustee under agreement with Paul E. White, dated 2/1/02”; “Carl A. Black and Henry B. Green, trustees under agreement with Paul E. White,

dated 2/1/02”; or “Paul E. White, trustee under declaration of trust dated 2/1/02 FBO Henry B. Green.”)

•

Show the mailing address for the trust. Series HH bonds will be delivered to this address unless you provide different mailing instructions

under “Delivery Instructions.”

•

For Series HH bonds, insert delivery instructions if you don’t want the bonds mailed to the address shown for the trust. Provide the name and

address of the person or institution you want to receive them.

•

For Series EE or Series I bonds, provide the TreasuryDirect account number for the trust. If you don’t have an account, you may open one at

TreasuryDirect.gov.

ITEM 4. TAX LIABILITY NOTICE – Carefully read this section before completing Item 5.

ITEM 5. TAX LIABILITY STATEMENT – After reading Item 4, "TAX LIABILITY NOTICE," you must mark box "a" or "b" in Item 5. Mark box "a" if

you will be treated as the owner of the portion of the trust represented by the tax-deferred accumulated interest on the bonds being reissued. Mark

box "b" if you will NOT be treated as owner of the portion of the trust represented by the tax-deferred accumulated interest on the bonds being

reissued. “Interest” includes tax-deferred interest represented by tax legends on Series HH bonds, as well as interest earned on Series EE or Series

I bonds from the issue date until the date of reissue.

ITEM 6. SIGNATURES – The completed form must be signed by the owner or both coowners and acting trustee. If any person whose signature

is required is deceased, submit proof of his or her death, in the form of a certified copy of the death certificate. If co-trustees, one must be

able to act individually on behalf of the trust. Only the trustee listed as the account manager of the TreasuryDirect trust account must

sign the form agreeing to electronic reissue into the TreasuryDirect account.

Each person whose signature is required must sign the form in ink, print his or her name, and provide his or her home address, Social Security

Number, daytime telephone number, and, if he or she has one, e-mail address. Each signature must be certified (see "CERTIFICATION" below).

CERTIFICATION – Each person whose signature is required must appear before and establish identification to the satisfaction of an authorized certifying

officer. The signatures to the form must be signed in the officer’s presence. The certifying officer must affix the seal or stamp, which is used when

certifying requests for payment. Authorized certifying officers are available at financial institutions, including credit unions, in the United States. For a list

of such officers, see Department of the Treasury Circulars, No 530, and Public Debt Series, Nos. 3-80 and 2-98.

ADDITIONAL REQUIREMENTS FOR REISSUE OF SERIES HH BONDS:

•

If a grantor (creator) of the trust who signs this form has been notified by the Internal Revenue Service (IRS) that he or she is subject to

backup withholding or if the IRS has notified appropriate persons that the trust estate is subject to backup withholding, the applicable

statements immediately above the signature line to the effect that the owner, principal coowner, or trust is not subject to backup withholding

should be crossed out. If the trust was created by some person other than the owner or coowners, the trustee must complete an IRS Form

W-9 and submit it with this request for reissue. Forms W-9 are available at financial institutions in the United States and Internal Revenue

Offices. These forms can also be found on the IRS website at

•

The furnishing of direct deposit information is a condition of reissue of Series HH bonds bearing issue dates of October 1989 and thereafter.

A direct deposit form, FS Form 5396 or SF 1199A, must be completed for Series HH bonds dated October 1989 and thereafter which are

submitted for reissue. The direct deposit form must be signed by all current acting trustees and must provide the appropriate information for

direct deposit of the semiannual interest payments. SF 1199A is available at financial institutions in the United States. FS Form 5396 is

available at The financial institution designated to receive the payment can assist in the completion of the direct

deposit form.

ADDITIONAL EVIDENCE – We reserve the right in any particular case to require the submission of additional evidence.

WHERE TO SEND – Send this form (FS Form 1851) and the bonds, as well as any other appropriate forms and evidence, to Treasury Retail Securities

Site, P.O. Box 214, Minneapolis, MN 55480-0214. Legal evidence or documentation you submit cannot be returned.

NOTICE OF PRIVACY ACT AND PAPERWORK REDUCTION ACT

The collection of the information you are requested to provide on this form is authorized by 31 U.S.C. CH. 31 relating to the public debt of the United States. The

furnishing of a Social Security Number, if requested, is also required by Section 6109 of the Internal Revenue Code (26 U.S.C. 6109).

The purpose of requesting the information is to enable the Bureau of the Fiscal Service and its agents to issue securities, process transactions, make payments,

identify owners and their accounts, and provide reports to the Internal Revenue Service. Furnishing the information is voluntary; however, without the information

the Fiscal Service may be unable to process transactions.

Information concerning securities holdings and transactions is considered confidential under Treasury regulations (31 CFR, Part 323) and the Privacy Act. This

information may be disclosed to a law enforcement agency for investigation purposes; courts and counsel for litigation purposes; others entitled to distribution or

payment; agents and contractors to administer the public debt; agencies or entities for debt collection or to obtain current addresses for payment; agencies through

approved computer matches; Congressional offices in response to an inquiry by the individual to whom the record pertains; as otherwise authorized by law or

regulation.

We estimate it will take you about 15 minutes to complete this form. However, you are not required to provide information requested unless a valid OMB control

number is displayed on the form. Any comments or suggestions regarding this form should be sent to the Bureau of the Fiscal Service, Forms Management

Officer, Parkersburg, WV 26106-1328. DO NOT SEND completed form to this address; send to the address shown in “WHERE TO SEND” in the instructions.

FS Form 1851

Department of the Treasury | Bureau of the Fiscal Service

5

1

1 2

2 3

3 4

4 5

5