Schedule M-1ed - Minnesota K-12 Education Credit - 1999

ADVERTISEMENT

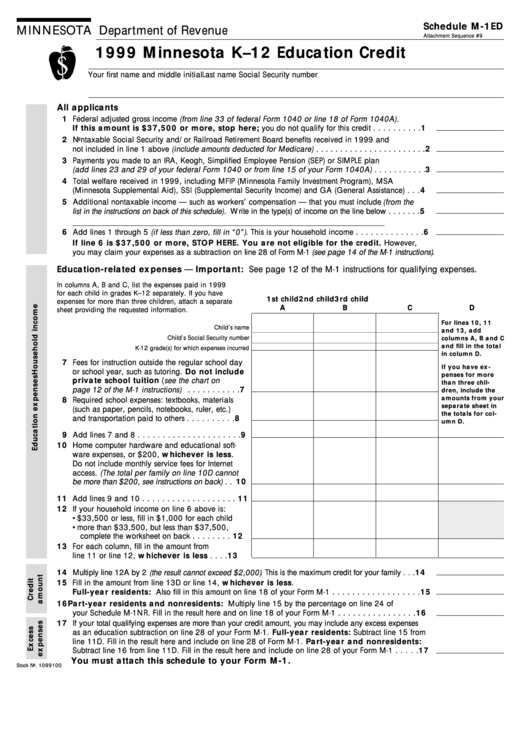

Schedule M-1ED

MINNESOTA Department of Revenue

Attachment Sequence #9

1999 Minnesota K–12 Education Credit

Your first name and middle initial

Last name

Social Security number

All applicants

1 Federal adjusted gross income (from line 33 of federal Form 1040 or line 18 of Form 1040A).

If this amount is $37,500 or more, stop here; you do not qualify for this credit . . . . . . . . . . 1

2 Nontaxable Social Security and/or Railroad Retirement Board benefits received in 1999 and

not included in line 1 above (include amounts deducted for Medicare) . . . . . . . . . . . . . . . . . . . . . . . 2

3 Payments you made to an IRA, Keogh, Simplified Employee Pension (SEP) or SIMPLE plan

(add lines 23 and 29 of your federal Form 1040 or from line 15 of your Form 1040A) . . . . . . . . . . . 3

4 Total welfare received in 1999, including MFIP (Minnesota Family Investment Program), MSA

(Minnesota Supplemental Aid), SSI (Supplemental Security Income) and GA (General Assistance) . . . 4

5 Additional nontaxable income — such as workers’ compensation — that you must include (from the

list in the instructions on back of this schedule). Write in the type(s) of income on the line below . . . . . . . 5

6 Add lines 1 through 5 (if less than zero, fill in “0”) . This is your household income . . . . . . . . . . . . . . 6

If line 6 is $37,500 or more, STOP HERE. You are not eligible for the credit. However,

you may claim your expenses as a subtraction on line 28 of Form M-1 (see page 14 of the M-1 instructions) .

Education-related expenses — Important: See page 12 of the M-1 instructions for qualifying expenses.

In columns A, B and C, list the expenses paid in 1999

for each child in grades K–12 separately. If you have

1st child

2nd child

3rd child

expenses for more than three children, attach a separate

A

B

C

D

sheet providing the requested information.

For lines 10, 11

Child’s name

and 13, add

Child’s Social Security number

columns A, B and C

and fill in the total

K-12 grade(s) for which expenses incurred

in column D.

7 Fees for instruction outside the regular school day

If you have ex-

or school year, such as tutoring. Do not include

penses for more

private school tuition ( see the chart on

than three chil-

page 12 of the M-1 instructions) . . . . . . . . . . . 7

dren, include the

amounts from your

8 Required school expenses: textbooks, materials

separate sheet in

(such as paper, pencils, notebooks, ruler, etc.)

the totals for col-

and transportation paid to others . . . . . . . . . . 8

umn D.

9 Add lines 7 and 8 . . . . . . . . . . . . . . . . . . . . . 9

10 Home computer hardware and educational soft-

ware expenses, or $200, whichever is less.

Do not include monthly service fees for Internet

access. (The total per family on line 10D cannot

be more than $200, see instructions on back) . . 10

11 Add lines 9 and 10 . . . . . . . . . . . . . . . . . . . 11

12 If your household income on line 6 above is:

• $33,500 or less, fill in $1,000 for each child

• more than $33,500, but less than $37,500,

complete the worksheet on back . . . . . . . . 12

13 For each column, fill in the amount from

line 11 or line 12, whichever is less . . . . 13

14 Multiply line 12A by 2 (the result cannot exceed $2,000) . This is the maximum credit for your family . . . 14

15 Fill in the amount from line 13D or line 14, whichever is less.

Full-year residents: Also fill in this amount on line 18 of your Form M-1 . . . . . . . . . . . . . . . . . . 15

16 Part-year residents and nonresidents: Multiply line 15 by the percentage on line 24 of

your Schedule M-1NR. Fill in the result here and on line 18 of your Form M-1 . . . . . . . . . . . . . . . . 16

17 If your total qualifying expenses are more than your credit amount, you may include any excess expenses

as an education subtraction on line 28 of your Form M-1. Full-year residents: Subtract line 15 from

line 11D. Fill in the result here and include on line 28 of Form M-1. Part-year and nonresidents:

Subtract line 16 from line 11D. Fill in the result here and include on line 28 of your Form M-1 . . . . . 17

You must attach this schedule to your Form M-1.

Stock No. 1099100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1