Instructions For Preparing Form 500ec Virginia Cooperative Modified Net Income Tax Returns - 2016

ADVERTISEMENT

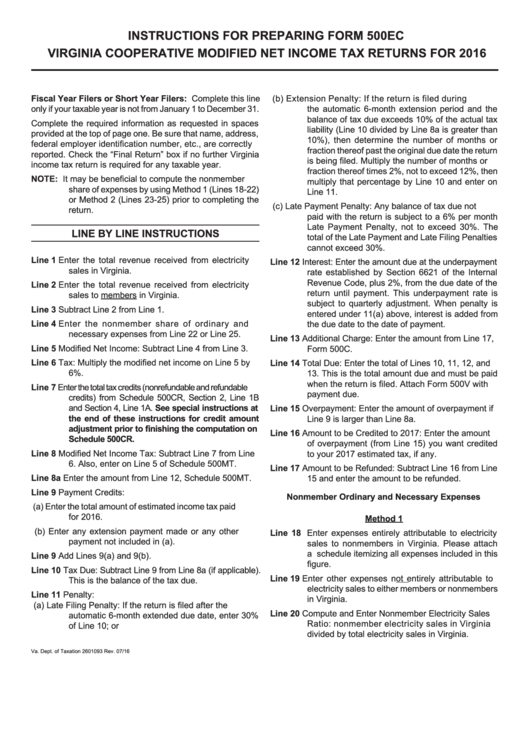

INSTRUCTIONS FOR PREPARING FORM 500EC

VIRGINIA COOPERATIVE MODIFIED NET INCOME TAX RETURNS FOR 2016

Fiscal Year Filers or Short Year Filers: Complete this line

(b) Extension Penalty: If the return is filed during

only if your taxable year is not from January 1 to December 31.

the automatic 6-month extension period and the

balance of tax due exceeds 10% of the actual tax

Complete the required information as requested in spaces

liability (Line 10 divided by Line 8a is greater than

provided at the top of page one. Be sure that name, address,

10%), then determine the number of months or

federal employer identification number, etc., are correctly

fraction thereof past the original due date the return

reported. Check the “Final Return” box if no further Virginia

is being filed. Multiply the number of months or

income tax return is required for any taxable year.

fraction thereof times 2%, not to exceed 12%, then

NOTE:

It may be beneficial to compute the nonmember

multiply that percentage by Line 10 and enter on

share of expenses by using Method 1 (Lines 18-22)

Line 11.

or Method 2 (Lines 23-25) prior to completing the

(c) Late Payment Penalty: Any balance of tax due not

return.

paid with the return is subject to a 6% per month

Late Payment Penalty, not to exceed 30%. The

LINE BY LINE INSTRUCTIONS

total of the Late Payment and Late Filing Penalties

cannot exceed 30%.

Line 1

Enter the total revenue received from electricity

Line 12 Interest: Enter the amount due at the underpayment

sales in Virginia.

rate established by Section 6621 of the Internal

Revenue Code, plus 2%, from the due date of the

Line 2

Enter the total revenue received from electricity

return until payment. This underpayment rate is

sales to members in Virginia.

subject to quarterly adjustment. When penalty is

Line 3

Subtract Line 2 from Line 1.

entered under 11(a) above, interest is added from

Line 4

Enter the nonmember share of ordinary and

the due date to the date of payment.

necessary expenses from Line 22 or Line 25.

Line 13 Additional Charge: Enter the amount from Line 17,

Line 5

Modified Net Income: Subtract Line 4 from Line 3.

Form 500C.

Line 6

Tax: Multiply the modified net income on Line 5 by

Line 14 Total Due: Enter the total of Lines 10, 11, 12, and

6%.

13. This is the total amount due and must be paid

when the return is filed. Attach Form 500V with

Line 7

Enter the total tax credits (nonrefundable and refundable

payment due.

credits) from Schedule 500CR, Section 2, Line 1B

and Section 4, Line 1A. See special instructions at

Line 15 Overpayment: Enter the amount of overpayment if

the end of these instructions for credit amount

Line 9 is larger than Line 8a.

adjustment prior to finishing the computation on

Line 16 Amount to be Credited to 2017: Enter the amount

Schedule 500CR.

of overpayment (from Line 15) you want credited

Line 8

Modified Net Income Tax: Subtract Line 7 from Line

to your 2017 estimated tax, if any.

6. Also, enter on Line 5 of Schedule 500MT.

Line 17 Amount to be Refunded: Subtract Line 16 from Line

Line 8a Enter the amount from Line 12, Schedule 500MT.

15 and enter the amount to be refunded.

Line 9

Payment Credits:

Nonmember Ordinary and Necessary Expenses

(a) Enter the total amount of estimated income tax paid

for 2016.

Method 1

(b) Enter any extension payment made or any other

Line 18 Enter expenses entirely attributable to electricity

payment not included in (a).

sales to nonmembers in Virginia. Please attach

a schedule itemizing all expenses included in this

Line 9

Add Lines 9(a) and 9(b).

figure.

Line 10 Tax Due: Subtract Line 9 from Line 8a (if applicable).

Line 19 Enter other expenses not entirely attributable to

This is the balance of the tax due.

electricity sales to either members or nonmembers

Line 11 Penalty:

in Virginia.

(a) Late Filing Penalty: If the return is filed after the

Line 20 Compute and Enter Nonmember Electricity Sales

automatic 6-month extended due date, enter 30%

Ratio: nonmember electricity sales in Virginia

of Line 10; or

divided by total electricity sales in Virginia.

Va. Dept. of Taxation 2601093 Rev. 07/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2