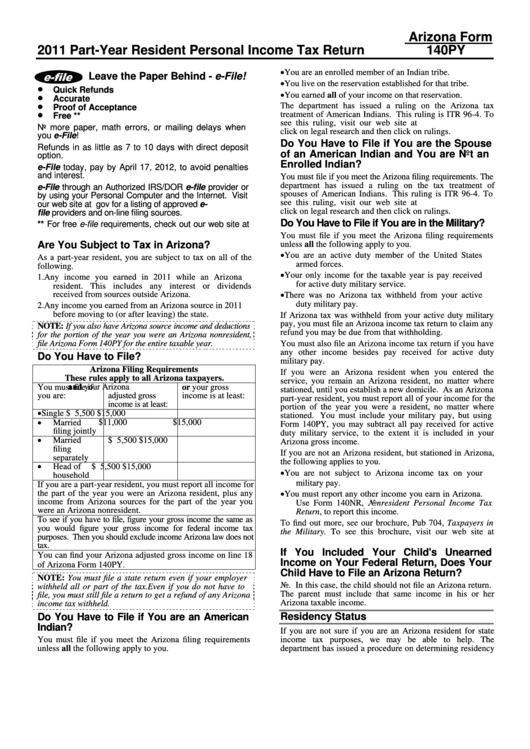

Instructions For Arizona Form 140py - Part-Year Resident Personal Income Tax Return - 2011

ADVERTISEMENT

Arizona Form

2011 Part-Year Resident Personal Income Tax Return

140PY

You are an enrolled member of an Indian tribe.

Leave the Paper Behind - e-File!

You live on the reservation established for that tribe.

Quick Refunds

You earned all of your income on that reservation.

Accurate

The department has issued a ruling on the Arizona tax

Proof of Acceptance

treatment of American Indians. This ruling is ITR 96-4. To

Free **

see this ruling, visit our web site at and

No more paper, math errors, or mailing delays when

click on legal research and then click on rulings.

you e-File!

Do You Have to File if You are the Spouse

Refunds in as little as 7 to 10 days with direct deposit

of an American Indian and You are Not an

option.

Enrolled Indian?

e-File today, pay by April 17, 2012, to avoid penalties

and interest.

You must file if you meet the Arizona filing requirements. The

department has issued a ruling on the tax treatment of

e-File through an Authorized IRS/DOR e-file provider or

spouses of American Indians. This ruling is ITR 96-4. To

by using your Personal Computer and the Internet. Visit

see this ruling, visit our web site at and

our web site at for a listing of approved e-

click on legal research and then click on rulings.

file providers and on-line filing sources.

Do You Have to File if You are in the Military?

** For free e-file requirements, check out our web site at

.

You must file if you meet the Arizona filing requirements

Are You Subject to Tax in Arizona?

unless all the following apply to you.

You are an active duty member of the United States

As a part-year resident, you are subject to tax on all of the

armed forces.

following.

Your only income for the taxable year is pay received

1. Any income you earned in 2011 while an Arizona

for active duty military service.

resident. This includes any interest or dividends

received from sources outside Arizona.

There was no Arizona tax withheld from your active

duty military pay.

2. Any income you earned from an Arizona source in 2011

before moving to (or after leaving) the state.

If Arizona tax was withheld from your active duty military

pay, you must file an Arizona income tax return to claim any

NOTE: If you also have Arizona source income and deductions

refund you may be due from that withholding.

for the portion of the year you were an Arizona nonresident,

file Arizona Form 140PY for the entire taxable year.

You must also file an Arizona income tax return if you have

any other income besides pay received for active duty

Do You Have to File?

military pay.

Arizona Filing Requirements

If you were an Arizona resident when you entered the

These rules apply to all Arizona taxpayers.

service, you remain an Arizona resident, no matter where

You must file if

and your Arizona

or your gross

stationed, until you establish a new domicile. As an Arizona

you are:

adjusted gross

income is at least:

part-year resident, you must report all of your income for the

income is at least:

portion of the year you were a resident, no matter where

Single

$ 5,500

$15,000

stationed. You must include your military pay, but using

Married

$11,000

$15,000

Form 140PY, you may subtract all pay received for active

filing jointly

duty military service, to the extent it is included in your

Married

$ 5,500

$15,000

Arizona gross income.

filing

If you are not an Arizona resident, but stationed in Arizona,

separately

the following applies to you.

Head of

$ 5,500

$15,000

You are not subject to Arizona income tax on your

household

military pay.

If you are a part-year resident, you must report all income for

the part of the year you were an Arizona resident, plus any

You must report any other income you earn in Arizona.

income from Arizona sources for the part of the year you

Use Form 140NR, Nonresident Personal Income Tax

were an Arizona nonresident.

Return, to report this income.

To see if you have to file, figure your gross income the same as

To find out more, see our brochure, Pub 704, Taxpayers in

you would figure your gross income for federal income tax

the Military. To see this brochure, visit our web site at

purposes. Then you should exclude income Arizona law does not

and click on publications.

tax.

If You Included Your Child's Unearned

You can find your Arizona adjusted gross income on line 18

Income on Your Federal Return, Does Your

of Arizona Form 140PY.

Child Have to File an Arizona Return?

NOTE: You must file a state return even if your employer

No. In this case, the child should not file an Arizona return.

withheld all or part of the tax. Even if you do not have to

The parent must include that same income in his or her

file, you must still file a return to get a refund of any Arizona

Arizona taxable income.

income tax withheld.

Do You Have to File if You are an American

Residency Status

Indian?

If you are not sure if you are an Arizona resident for state

You must file if you meet the Arizona filing requirements

income tax purposes, we may be able to help. The

department has issued a procedure on determining residency

unless all the following apply to you.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25