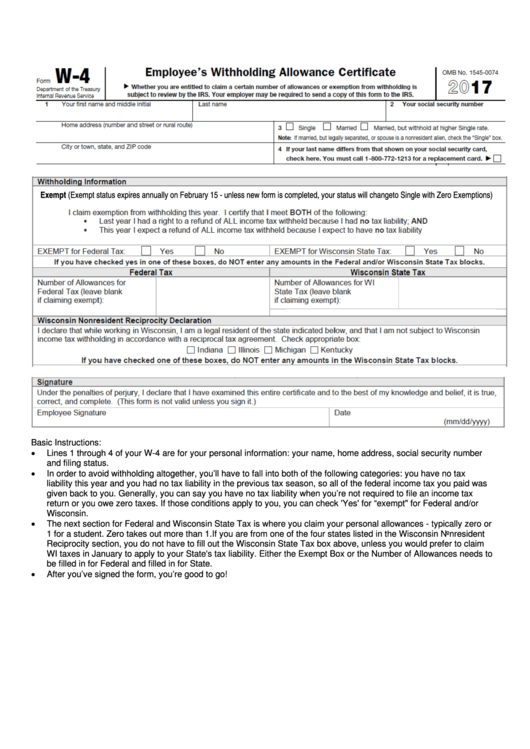

Form W-4 - Employee'S Withholding Allowance Certificate - Internal Revenue Service - 2017

ADVERTISEMENT

Exempt (Exempt status expires annually on February 15 - unless new form is completed, your status will change to Single with Zero Exemptions)

Basic Instructions:

•

Lines 1 through 4 of your W-4 are for your personal information: your name, home address, social security number

and filing status.

•

In order to avoid withholding altogether, you’ll have to fall into both of the following categories: you have no tax

liability this year and you had no tax liability in the previous tax season, so all of the federal income tax you paid was

given back to you. Generally, you can say you have no tax liability when you’re not required to file an income tax

return or you owe zero taxes. If those conditions apply to you, you can check 'Yes' for “exempt" for Federal and/or

Wisconsin.

•

The next section for Federal and Wisconsin State Tax is where you claim your personal allowances - typically zero or

1 for a student. Zero takes out more than 1. If you are from one of the four states listed in the Wisconsin Nonresident

Reciprocity section, you do not have to fill out the Wisconsin State Tax box above, unless you would prefer to claim

WI taxes in January to apply to your State's tax liability. Either the Exempt Box or the Number of Allowances needs to

be filled in for Federal and filled in for State.

•

After you’ve signed the form, you’re good to go!

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1