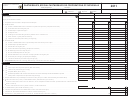

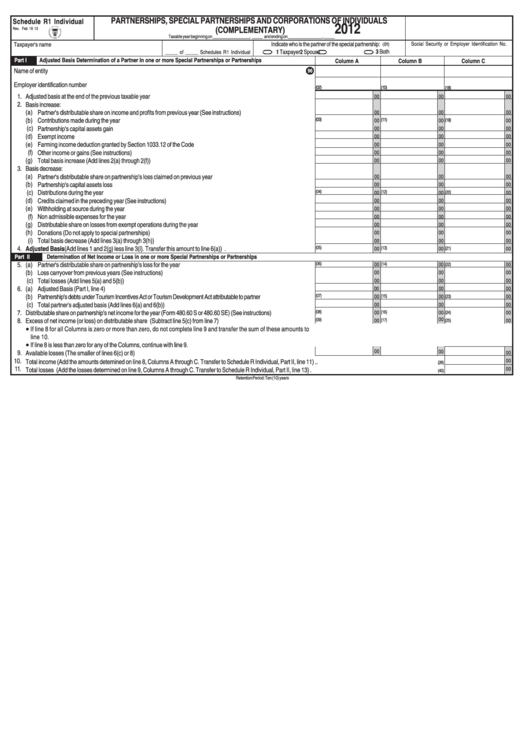

Schedule R1 Individual - Partnerships, Special Partnerships And Corporations Of Individuals (Complementary) - 2012

ADVERTISEMENT

PARTNERSHIPS, SPECIAL PARTNERSHIPS AND CORPORATIONS OF INDIVIDUALS

Schedule R1 Individual

2012

(COMPLEMENTARY)

Rev. Feb 19 13

Taxable year beginning on _________________, _____ and ending on ________________, _____

Taxpayer's name

Indicate who is the partner of the special partnership:

Social Security or Employer Identification No.

(01)

1 Taxpayer

2 Spouse

3 Both

_____ of _____ Schedules R1 Individual

Part I

Adjusted Basis Determination of a Partner in one or more Special Partnerships or Partnerships

Column A

Column B

Column C

Name of entity ..............................................................................................................................................................................

96

Employer identification number .....................................................................................................................................................

(02)

(10)

(18)

1.

Adjusted basis at the end of the previous taxable year .........................................................................................................

00

00

00

2.

Basis increase:

(a)

Partner's distributable share on income and profits from previous year (See instructions) ............................................

00

00

00

(b)

Contributions made during the year .............................................................................................................................

(03)

00

(11)

00

(19)

00

(c)

Partnership's capital assets gain ...................................................................................................................................

00

00

00

(d)

Exempt income ............................................................................................................................................................

00

00

00

(e)

Farming income deduction granted by Section 1033.12 of the Code ............................................................................

00

00

00

(f)

Other income or gains (See instructions) ......................................................................................................................

00

00

00

(g)

Total basis increase (Add lines 2(a) through 2(f)) ........................................................................................................

00

00

00

3.

Basis decrease:

(a)

Partner's distributable share on partnership's loss claimed on previous year ...............................................................

00

00

00

(b)

Partnership's capital assets loss ...................................................................................................................................

00

00

00

(c)

Distributions during the year ........................................................................................................................................

(04)

(12)

(20)

00

00

00

(d)

Credits claimed in the preceding year (See instructions) ................................................................................................

00

00

00

(e)

Withholding at source during the year ..........................................................................................................................

00

00

00

(f)

Non admissible expenses for the year .........................................................................................................................

00

00

00

(g)

Distributable share on losses from exempt operations during the year .........................................................................

00

00

00

(h)

Donations (Do not apply to special partnerships) .........................................................................................................

00

00

00

(i)

Total basis decrease (Add lines 3(a) through 3(h)) ......................................................................................................

00

00

00

4.

Adjusted Basis (Add lines 1 and 2(g) less line 3(i). Transfer this amount to line 6(a)) ......................................................

(05)

00

(13)

00

(21)

00

Part II

Determination of Net Income or Loss in one or more Special Partnerships or Partnerships

5.

(a)

(06)

Partner's distributable share on partnership's loss for the year ......................................................................................

00

(14)

00

00

(22)

(b)

Loss carryover from previous years (See instructions) .................................................................................................

00

00

00

(c)

Total losses (Add lines 5(a) and 5(b)) ...........................................................................................................................

00

00

00

6.

(a)

Adjusted Basis (Part I, line 4) ........................................................................................................................................

00

00

00

(b)

Partnership's debts under Tourism Incentives Act or Tourism Development Act attributable to partner ....................................

(07)

00

(15)

00

(23)

00

(c)

Total partner's adjusted basis (Add lines 6(a) and 6(b)) ................................................................................................

00

00

00

7.

.

Distributable share on partnership's net income for the year (Form 480.60 S or 480.60 SE) (See instructions) .........................

(08)

(16)

00

00

(24)

00

00

8.

Excess of net income (or loss) on distributable share (Subtract line 5(c) from line 7) ............................................................

(09)

00

(17)

(25)

00

.

If line 8 for all Columns is zero or more than zero, do not complete line 9 and transfer the sum of these amounts to

line 10.

If line 8 is less than zero for any of the Columns, continue with line 9.

00

00

9.

Available losses (The smaller of lines 6(c) or 8) ...................................................................................................................

00

10.

Total income (Add the amounts detemined on line 8, Columns A through C. Transfer to Schedule R Individual, Part II, line 11) ................................................................................

00

(26)

11.

00

Total losses (Add the losses determined on line 9, Columns A through C. Transfer to Schedule R Individual, Part II, line 13) ....................................................................................

(40)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2