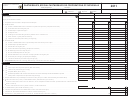

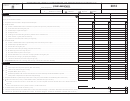

Schedule R1 Individual - Partnerships, Special Partnerships And Corporations Of Individuals (Complementary) - 2012 Page 2

ADVERTISEMENT

Rev. Feb 19 13

Schedule R1 Individual - Page 2

Part III

Adjusted Basis Determination of a Stockholder in one or more Corporations of Individuals

Column A

Column B

Column C

Name of entity ...........................................................................................................................................................................

Employer identification number ..................................................................................................................................................

(50)

(41)

(59)

(51)

(60)

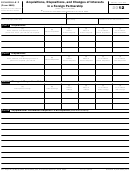

1.

Adjusted basis at the end of the previous taxable year .................................................................................................................

(42)

00

00

00

2.

Basis increase:

(a)

Stockholder’s distributable share on income and profits from previous year (See instructions) ........................................

00

00

00

(52)

(61)

(b)

(43)

Contributions made during the year ..............................................................................................................................

00

00

00

(c)

Corporation of individual’s capital assets gain ..............................................................................................................

00

00

00

(d)

Exempt income .............................................................................................................................................................

00

00

00

(e)

Farming income deduction granted by Section 1033.12 of the Code .............................................................................

00

00

00

(f)

Other income or gains (See instructions) ......................................................................................................................

00

00

00

(g)

Total basis increase (Add lines 2(a) through 2(f)) .........................................................................................................

00

00

00

3.

Basis decrease:

00

(a)

Stockholder’s distributable share on corporation of individual’s loss claimed on previous year .......................................

00

00

00

(b)

Corporation of individual’s capital assets loss .................................................................................................................

00

00

(53)

(c)

(44)

(62)

Distributions during the year ........................................................................................................................................

00

00

00

(d)

Credits claimed in the preceding year (See instructions) .................................................................................................

00

00

00

(e)

Withholding at source during the year ...........................................................................................................................

00

00

00

(f)

Non admissible expenses for the year ...........................................................................................................................

00

00

00

(g)

Distributable share on losses from exempt operations during the year ..........................................................................

00

00

00

(h)

Total basis decrease (Add lines 3(a) through 3(g)) .......................................................................................................

00

00

00

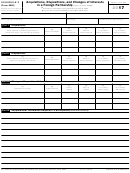

(54)

4.

(45)

(63)

Adjusted Basis (Add lines 1 and 2(g) less line 3(h). Transfer this amount to line 6(a)) .....................................................

00

00

00

Part IV

Determination of Net Income or Loss in one or more Corporations of Individuals

(46)

(55)

(64)

5.

(a)

Stockholder’s distributable share on corporation of individual’s loss for the year .........................................................

00

00

00

(b)

Loss carryover from previous years (See instructions) ...............................................................................................

00

00

00

(c)

Total losses (Add lines 5(a) and 5(b)) .........................................................................................................................

00

00

00

00

00

6.

(a)

Adjusted Basis (Part III, line 4) ....................................................................................................................................

00

(47)

(56)

(65)

(b)

Corporation of individual’s debts under Tourism Incentives Act or Tourism Development Act attributable to stockholder

00

00

00

(c)

Total stockholder’s adjusted basis (Add lines 6(a) and 6(b)) .......................................................................................

00

00

00

(48)

(57)

(66)

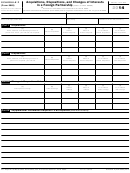

7.

.

Distributable share on corporation of individual’s net income for the year (See instructions)

00

00

00

(49)

(58)

(67)

8.

Excess of net income (or loss) on distributable share (Subtract line 5(c) from line 7)

00

00

00

.

If line 8 for all Columns is zero or more than zero, do not complete line 9 and transfer the sum of these amounts to

line 10.

If line 8 is less than zero for any of the Columns, continue with line 9.

9.

00

00

Available losses (The smaller of lines 6(c) or 8) ..................................................................................................................

00

10.

00

Total income (Add the amounts determined on line 8, Columns A through C.

Transfer to Schedule R Individual, Part IV, line 11)

............................................................................

(68)

11.

Total losses (Add the losses determined on line 9, Columns A through C.

Transfer to Schedule R Individual, Part IV, line 13)

.................................................................................

00

(80)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2