Form Rt51 - Oil Discharge & Pollution Control Report Page 2

ADVERTISEMENT

INSTRUCTIONS

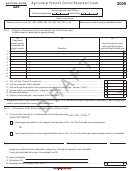

(Use Whole Gallons Only)

RT 51

1. This report must be filed in the actual name of the licensee and for each calendar month as long as the license is retained. “Every person who

imports or causes to be imported oil shall file a monthly report for the preceding month and shall include all fees due for that reporting period.”

2. A report must be filed although there were no operations during the month. “ All required reports shall be filed, even in those cases where no

operation occurred within the state…”

3. All reports must be postmarked “on or before the twentieth day of the following calendar month.”

4. “ Failure to file by the required date or to enclose fees due shall result in the assessment of a 10 percent penalty to be added to the amount of

fees due for that month. If no fees are due, a penalty of $1 per day shall be assessed. Said penalty shall immediately accrue and thereafter the

overdue fees and the penalty shall bear interest…”

5. Report and payment must be submitted together.

6. Additional forms may be requested from this office or may be duplicated on your office copier. “A facsimile of the official forms provided

by this bureau shall be accepted by the bureau if the licensee does not have access to the official forms.”

7. One schedule per product shall be submitted with the monthly report. Each schedule shall include the delivery date (for each receipt/sale),

transporter name, your supplier’s name, origin state, and the customer/purchaser name/address, the product type, and the quantity of gallons

(for each receipt/sale). (See instructions under RECEIPTS and DISTRIBUTION).

8. Diesel Fuel Column: All diesel products (including any added clear kerosene).

9. Heating Oil Column: All oil used for heating purposes such as #2, #6, dyed kerosene and waste oil. (See Fuel Oil Exemptions below).

10. Motor Oil Column: All motor/automotive lubricating oil and transmission fluid.

11. “Other” Column: Oil based products not listed as separate columns (such as cutting oils, petroleum cleaning solvents, etc.)

RECEIPTS

Line 1: List only receipts of product imported from sources outside NH and complete Schedule #45-1 as required in detail.

Line 2: List only receipts of product purchased from sources within NH and complete Schedule #45-2 as required in detail.

Line 3: Totals of Lines 1 and 2

DISTRIBUTION

Line 4: List sales and transfers out of state (out of NH) and complete Schedule #45-4 as required in detail.

Line 5: List product on which you paid the fee/tax to your supplier at the time of purchase and complete Schedule #45-5 as required in detail.

Line 6. Total Non-Taxable (Line 4 and 5).

Line 7. Total Taxable (Line 3 minus Line 6).

TAX COMPUTATION

Lines 8, 12, 16, & 20: Enter the total net adjustments applicable to the specific fund (which may be an addition or a deduction) and attach a

detailed explanation to the report. These adjustments are for product transfers, corrections or exemptions to product and NOT to be used to

show the results of a NH audit.

Lines 9, 13, 17, & 21: Enter the proper taxable gallons (from Line 7).

Lines 10, 14, 18, & 22: Enter proper net taxable gallons (total of prior two lines).

Lines 11, 15, 19, 23, & 24: Compute total dollars due or (refund) for each specific fund.

NOTE:

Lines 20-23: Automotive Oil/Motor Oil Discharge-Two separate fees Automotive Oil fee ($.02) and the Motor Oil Discharge ($.04) are

combined in this section.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2