Arizona Form A-4c - Request For Reduced Withholding To Designate For Tax Credits - 2017

ADVERTISEMENT

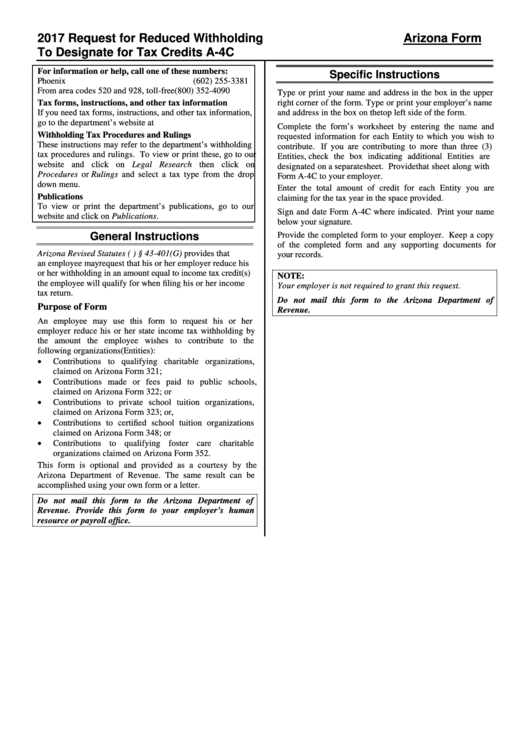

2017 Request for Reduced Withholding

Arizona Form

To Designate for Tax Credits

A-4C

For information or help, call one of these numbers:

Specific Instructions

Phoenix

(602) 255-3381

From area codes 520 and 928, toll-free

(800) 352-4090

Type or print your name and address in the box in the upper

right corner of the form. Type or print your employer’s name

Tax forms, instructions, and other tax information

If you need tax forms, instructions, and other tax information,

and address in the box on the top left side of the form.

go to the department’s website at

Complete the form’s worksheet by entering the name and

Withholding Tax Procedures and Rulings

requested information for each Entity to which you wish to

These instructions may refer to the department’s withholding

contribute. If you are contributing to more than three (3)

tax procedures and rulings. To view or print these, go to our

Entities, check the box indicating additional Entities are

website and click on Legal Research then click on

designated on a separate sheet. Provide that sheet along with

Procedures or Rulings and select a tax type from the drop

Form A-4C to your employer.

down menu.

Enter the total amount of credit for each Entity you are

Publications

claiming for the tax year in the space provided.

To view or print the department’s publications, go to our

Sign and date Form A-4C where indicated. Print your name

website and click on Publications.

below your signature.

General Instructions

Provide the completed form to your employer. Keep a copy

of the completed form and any supporting documents for

Arizona Revised Statutes (A.R.S.) § 43-401(G) provides that

your records.

an employee may request that his or her employer reduce his

or her withholding in an amount equal to income tax credit(s)

NOTE:

the employee will qualify for when filing his or her income

Your employer is not required to grant this request.

tax return.

Do not mail this form to the Arizona Department of

Purpose of Form

Revenue.

An employee may use this form to request his or her

employer reduce his or her state income tax withholding by

the amount the employee wishes to contribute to the

following organizations (Entities):

•

Contributions to qualifying charitable organizations,

claimed on Arizona Form 321;

•

Contributions made or fees paid to public schools,

claimed on Arizona Form 322; or

•

Contributions to private school tuition organizations,

claimed on Arizona Form 323; or,

•

Contributions to certified school tuition organizations

claimed on Arizona Form 348; or

•

Contributions to qualifying foster care charitable

organizations claimed on Arizona Form 352.

This form is optional and provided as a courtesy by the

Arizona Department of Revenue. The same result can be

accomplished using your own form or a letter.

Do not mail this form to the Arizona Department of

Revenue. Provide this form to your employer’s human

resource or payroll office.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1