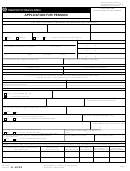

SECTION VII: INCOME VERIFICATION - NET WORTH

(MUST COMPLETE)

25. NET WORTH (DO NOT LEAVE ANY ITEMS BLANK. If your household has no net worth in a particular source, write "0" or "none")

Report total net worth for your household. You must report your net worth and the net worth of your dependents (spouse, child, etc.), if any. Identify the

specific owner for each net worth source, yourself or another person in your household, as applicable.

SOURCE

AMOUNT

OWNER

SOURCE

AMOUNT

OWNER

CASH/NON-INTEREST

REAL PROPERTY

BEARING BANK

(Not your home, vehicle,

ACCOUNTS

furniture, or clothing)

$

$

INTEREST-BEARING

ALL OTHER PROPERTY

BANK ACCOUNTS

(Please write source)

$

$

IRA'S, KEOGH PLANS,

ALL OTHER PROPERTY

ETC.

(Please write source)

$

$

OTHER (Provide source)

STOCKS, BONDS,

MUTUAL FUNDS, ETC.

$

$

SECTION VIII: INCOME VERIFICATION - MONTHLY INCOME (MUST COMPLETE

)

26. GROSS MONTHLY INCOME (DO NOT LEAVE ANY ITEMS BLANK. If no income was received from a particular source, write "0" or "none")

Report total monthly income for your household. You must report your income and the income of your dependents (spouse, child, etc.), if any. Identify

the specific income recipient for each income source, yourself or another person in your household, as applicable.

SOURCE

AMOUNT

RECIPIENT

SOURCE

AMOUNT

RECIPIENT

SOCIAL SECURITY

SERVICE RETIREMENT

$

$

SUPPLEMENTAL SECURITY

SOCIAL SECURITY

INCOME (SSI)/PUBLIC

$

$

ASSISTANCE

OTHER (Provide source)

U.S. CIVIL SERVICE

$

$

OTHER (Provide source)

U.S. RAILROAD

RETIREMENT

$

$

OTHER (Provide source)

BLACK LUNG

BENEFITS

$

$

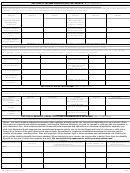

SECTION IX: EXPECTED INCOME

(MUST COMPLETE)

27. EXPECTED INCOME - NEXT 12 MONTHS (DO NOT LEAVE ANY ITEMS BLANK. If no income was received from a particular source, write "0" or "none")

Report expected total household income for the next 12 months. You must report your expected income and the expected income of your dependents

(spouse, child, etc.), if any. Identify the specific income recipient for each income source, yourself or another person in your household, as applicable.

SOURCE

AMOUNT

RECIPIENT

SOURCE

AMOUNT

RECIPIENT

OTHER INCOME

GROSS WAGES AND

EXPECTED (Provide source)

SALARY

$

$

OTHER INCOME

GROSS WAGES AND

EXPECTED (Provide source)

SALARY

$

$

OTHER INCOME

TOTAL DIVIDENDS AND

EXPECTED (Provide source)

INTEREST

$

$

SECTION X: MEDICAL, LEGAL, OR OTHER UNREIMBURSED EXPENSES

(MUST COMPLETE)

28. MEDICAL, LEGAL, OR OTHER UNREIMBURSED EXPENSES (IF NONE WRITE "0" OR "NONE")

Report your family medical expenses and certain other expenses actually paid by you that may be deductible from your income. Show

the amount of unreimbursed medical expenses, including the Medicare deduction you paid for yourself or relatives who are members of

your household. Also, show unreimbursed last illness and burial expenses and educational or vocational rehabilitation expenses you

paid. Last illness and burial expenses are unreimbursed amounts paid by you for the last illness and burial of a spouse or child at any

time prior to the end of the year following the year of death. Educational or vocational rehabilitation expenses are amounts paid for

courses of education, including tuition, fees, and materials. Show medical, legal or other expenses you paid because of a disability for

which civilian disability benefits have been awarded. When determining your income, we may be able to deduct them from the disability

benefits for the year in which the expenses are paid. Do not include any expenses for which you were reimbursed.

PURPOSE

RELATIONSHIP OF PERSON

DATE PAID

PAID TO (Name of doctor,

AMOUNT PAID BY YOU

(Doctor's fees, hospital charges, attorney fees, tuition,

FOR WHOM EXPENSES PAID

(mm/dd/yy)

hospital, pharmacy, etc.)

education materials, etc.)

(Spouse, child, etc.)

$

$

$

$

VA FORM 21-527EZ, JUN 2014

Page 7

1

1 2

2 3

3 4

4