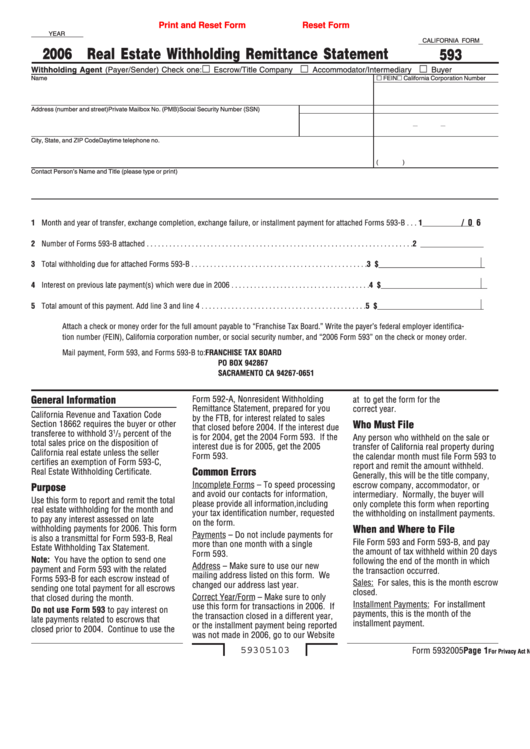

Print and Reset Form

Reset Form

YEAR

CALIFORNIA FORM

2006

Real Estate Withholding Remittance Statement

593

Withholding Agent (Payer/Sender) Check one:

Escrow/Title Company

Accommodator/Intermediary

Buyer

Name

FEIN

California Corporation Number

Address (number and street)

Private Mailbox No. (PMB) Social Security Number (SSN)

City, State, and ZIP Code

Daytime telephone no.

(

)

Contact Person’s Name and Title (please type or print)

/ 06

1 Month and year of transfer, exchange completion, exchange failure, or installment payment for attached Forms 593-B . . . 1 ______ _______

2 Number of Forms 593-B attached . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 ________________

3 Total withholding due for attached Forms 593-B . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 $___________________________

4 Interest on previous late payment(s) which were due in 2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 $___________________________

5 Total amount of this payment. Add line 3 and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 $___________________________

Attach a check or money order for the full amount payable to “Franchise Tax Board.” Write the payer’s federal employer identifica-

tion number (FEIN), California corporation number, or social security number, and “2006 Form 593” on the check or money order.

Mail payment, Form 593, and Forms 593-B to:

FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0651

Form 592-A, Nonresident Withholding

General Information

at to get the form for the

Remittance Statement, prepared for you

correct year.

California Revenue and Taxation Code

by the FTB, for interest related to sales

Section 18662 requires the buyer or other

Who Must File

that closed before 2004. If the interest due

1

transferee to withhold 3

/

percent of the

3

is for 2004, get the 2004 Form 593. If the

Any person who withheld on the sale or

total sales price on the disposition of

interest due is for 2005, get the 2005

transfer of California real property during

California real estate unless the seller

Form 593.

the calendar month must file Form 593 to

certifies an exemption of Form 593-C,

report and remit the amount withheld.

Common Errors

Real Estate Withholding Certificate.

Generally, this will be the title company,

Incomplete Forms – To speed processing

escrow company, accommodator, or

Purpose

and avoid our contacts for information,

intermediary. Normally, the buyer will

Use this form to report and remit the total

please provide all information,including

only complete this form when reporting

real estate withholding for the month and

your tax identification number, requested

the withholding on installment payments.

to pay any interest assessed on late

on the form.

withholding payments for 2006. This form

When and Where to File

Payments – Do not include payments for

is also a transmittal for Form 593-B, Real

File Form 593 and Form 593-B, and pay

more than one month with a single

Estate Withholding Tax Statement.

the amount of tax withheld within 20 days

Form 593.

Note: You have the option to send one

following the end of the month in which

Address – Make sure to use our new

payment and Form 593 with the related

the transaction occurred.

mailing address listed on this form. We

Forms 593-B for each escrow instead of

Sales: For sales, this is the month escrow

changed our address last year.

sending one total payment for all escrows

closed.

Correct Year/Form – Make sure to only

that closed during the month.

Installment Payments: For installment

use this form for transactions in 2006. If

Do not use Form 593 to pay interest on

payments, this is the month of the

the transaction closed in a different year,

late payments related to escrows that

installment payment.

or the installment payment being reported

closed prior to 2004. Continue to use the

was not made in 2006, go to our Website

59305103

Form 593 2005 Page 1

For Privacy Act Notice, get form FTB 1131 (Individuals only).

1

1