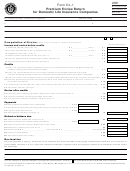

Form Dl-2 - Investment Privilege Excise Return For Domestic Life Insurance Companies - 1999 Page 4

ADVERTISEMENT

How Is the Excise Determined?

The numerator of the payroll factor equals all compensations paid

in Massachusetts during the taxable year. Compensation is defined

Every life insurance company which has contributed its full proportion-

as wages, salaries, commissions and other remuneration, whether or

ate share to the life initiative for the current taxable year, shall annu-

not paid to employees of the insurer.

ally pay an investment income for the taxable year beginning January

1, 1999 at 12%. All other companies must pay 14%. A certificate of

The denominator of the payroll factor equals the total amount of

contribution issued by the Life Insurance Company Initiative must ac-

compensation paid both inside and outside Massachusetts.

company the return if claiming the lower rate.

Dividends Deduction

Are Combined Returns Allowed?

A deduction is provided for dividends reported on Pro Forma 1120L,

No. Domestic insurance companies are not allowed to participate in

Schedule A, lines 2a through 2e, multiplied by the company’s share,

filing combined returns.

excluding: dividends from Massachusetts corporate trusts; dividends

Line Instructions

from non-wholly owned DISCs; and dividends less than 15% of vot-

ing stock, if included in Schedule A of Pro Forma 1120L.

Registration Information

Enter the company’s federal identification number in the box next to

Credits Against Excise

the name and address of the company.

Domestic life insurance companies with admitted assets of less than

$240 million are allowed a credit of $500 for each $1 million below

Should the Whole Dollar Method be Used?

$240 million up to a maximum of $20 thousand.

Yes. All amounts entered on Form DL-2 must be rounded off to the

nearest dollar.

Domestic life insurance companies can claim the Economic Opportu-

nity Area credit by entering the amount from Schedule EOA, line 9 on

Federal Audit

this form. Attach a completed Schedule EOA to this return. For more

If your corporation has undergone a federal audit for some prior year,

information, contact the Massachusetts Office of Business Develop-

you must report any changes to Massachusetts on Form 355FC. You

ment at One Ashburton Place, Room 2101, Boston, MA 02108.

must report any federal audit changes within three months after the

final determination by the IRS of the correct taxable income. Other-

Full Employment Program Credit

wise, you will be subject to a penalty. Answering “yes” to this ques-

A qualified employer participarting in the Full Employment Program

tion does not release the corporation from this filing obligation.

may claim a credit of $100 per month of eligible employment per em-

ployee. The maximum amount of credit that may be applied in all tax-

Apportionment

able years with respect to each employee is $1,200. Attach Schedule

Massachusetts income apportionment is based on two factors: the

FEC to this return. For more information, contact the Department of

premium factor and the payroll factor. The premium apportionment

Transitional Assistance, 600 Washington Street, Boston, MA 02111.

percentage and the payroll apportionment percentage are combined

Voluntary Contribution for Endangered Wildlife

and divided by 10 to arrive at the Massachusetts apportionment per-

centage. The apportionment percentage cannot exceed 20%.

Conservation

Any corporation that wishes to contribute any amount to the Natural

The numerator of the premium factor is the sum of life insurance

Heritage and Endangered Species Fund may do so on this form. This

premiums, annuity considerations and accident and health premiums

amount is added to the excise due. It increases the amount of the cor-

received during the taxable year with respect to direct business in the

poration’s payment or reduces the amount of its refund.

Commonwealth. Premiums and annuities in jurisdictions where no

taxes are paid must be included in the numerator. Premiums for com-

The Natural Heritage and Endangered Species Fund is administered

panies’ employee group plans are excludable from the numerator of

by the Department of Fisheries, Wildlife and Environmental Law En-

the premium factor if they were included on Schedule T of the NAIC

forcement to provide for conservation programs for rare, endangered

annual statement.

and nongame wildlife and plants in the Commonwealth.

The denominator of the premium factor is the total of all life in-

Signature

surance premiums, annuity considerations and accident and health

When the form is complete, it must be signed by the treasurer or as-

premiums received during the taxable year, excluding: dividends to

sistant treasurer. If you are signing as an authorized delegate of the

purchase paid-up additions; dividends to shorten premium paying pe-

appropriate corporate officer, check the box in the signature section

riod; and considerations waived under contract provisions. Premiums

and attach a Mass. Form M-2848, Power of Attorney. Mail forms to:

for company employees’ group plans are also excluded from the de-

Massachusetts Department of Revenue

nominator.

PO Box 7052

Boston, MA 02204

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4