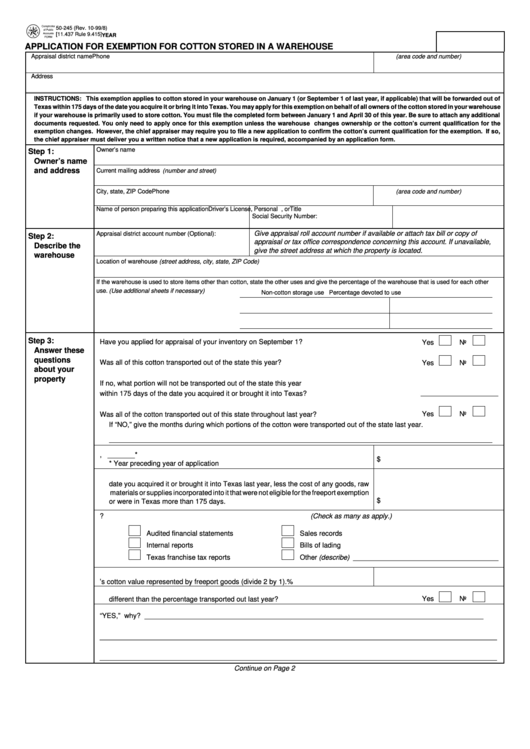

Form 50-245 - Application For Exemption For Cotton Stored In A Warehouse

ADVERTISEMENT

50-245 (Rev. 10-99/8)

[11.437 Rule 9.415]

YEAR

APPLICATION FOR EXEMPTION FOR COTTON STORED IN A WAREHOUSE

Appraisal district name

Phone (area code and number)

Address

INSTRUCTIONS: This exemption applies to cotton stored in your warehouse on January 1 (or September 1 of last year, if applicable) that will be forwarded out of

Texas within 175 days of the date you acquire it or bring it into Texas. You may apply for this exemption on behalf of all owners of the cotton stored in your warehouse

if your warehouse is primarily used to store cotton. You must file the completed form between January 1 and April 30 of this year. Be sure to attach any additional

documents requested. You only need to apply once for this exemption unless the warehouse changes ownership or the cotton’s current qualification for the

exemption changes. However, the chief appraiser may require you to file a new application to confirm the cotton’s current qualification for the exemption. If so,

the chief appraiser must deliver you a written notice that a new application is required, accompanied by an application form.

Owner’s name

Step 1:

Owner’s name

and address

Current mailing address (number and street)

City, state, ZIP Code

Phone (area code and number)

Name of person preparing this application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number:

Give appraisal roll account number if available or attach tax bill or copy of

Appraisal district account number (Optional):

Step 2:

appraisal or tax office correspondence concerning this account. If unavailable,

Describe the

give the street address at which the property is located.

warehouse

Location of warehouse (street address, city, state, ZIP Code)

If the warehouse is used to store items other than cotton, state the other uses and give the percentage of the warehouse that is used for each other

use. (Use additional sheets if necessary)

Non-cotton storage use

Percentage devoted to use

Step 3:

Have you applied for appraisal of your inventory on September 1? .......................................................

Yes

No

Answer these

questions

Was all of this cotton transported out of the state this year? ..................................................................

Yes

No

about your

property

If no, what portion will not be transported out of the state this year

within 175 days of the date you acquired it or brought it into Texas? .....................................................

Yes

No

Was all of the cotton transported out of this state throughout last year? ................................................

If “NO,” give the months during which portions of the cotton were transported out of the state last year.

1. Give the total cost of cotton sold for the entire year ending December 31, _______*

$

* Year preceding year of application

2. Give the total cost of cotton sold that was shipped out of Texas within 175 days of the

date you acquired it or brought it into Texas last year, less the cost of any goods, raw

materials or supplies incorporated into it that were not eligible for the freeport exemption

$

or were in Texas more than 175 days.

3. On what types of records do you base the amounts given above? (Check as many as apply.)

Audited financial statements

Sales records

Internal reports

Bills of lading

Texas franchise tax reports

Other (describe) _____________________________________

4. Percentage of last year’s cotton value represented by freeport goods (divide 2 by 1).

%

5. Will the percentage of cotton transported out of Texas this year be significantly

Yes

No

different than the percentage transported out last year?

6. If “YES,” why? _______________________________________________________________________________________

______________________________________________________________________________________________________

______________________________________________________________________________________________________

Continue on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2