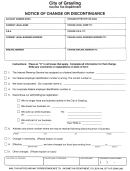

Form Albion 3102 - Notice Of Change Or Discontinuance For Albion City Taxes Page 3

ADVERTISEMENT

dependent. Additional exemptions are

After computing the tax, ignore all

5. Pensions and annuities, worker's

allowed if either the employee or his

fractions less than 50 ($0.50) cents

compensation and similar benefits.

or her spouse is age 65 or older.

and raise all fractions of 50 ($0.50)

6. Amounts paid for sickness, per-

cents and over to the next cent.

Do not mail AL-W4 cards to

sonal injury or disability, to the

Albion. These cards are for the

extent that these amounts are

COMPENSATION

employer's use and should be kept for

exempt from federal income tax.

Albion income tax must be withheld

six years.

You may withhold Albion tax from

from all compensation paid to Albion

these payments if you also withhold

HOW MUCH TO WITHHOLD

residents for work performed,

federal tax from them.

regardless of whether the work is

You may determine how much to

7. Amounts paid to employees as

done in or out of the city. It must also

withhold by using the tables included

reimbursement for expenses

be withheld from all similar compen-

in this booklet. These tables include

incurred in performing their work.

sation for work performed in the city

weekly, bi-weekly, semi-monthly,

by nonresidents for whom Albion is

Note: While individuals with

monthly and per diem pay periods and

the predominant place of employ-

income described in items 1, 2 and

list the correct withholding for

ment. Compensation includes salaries,

3 are not subject to withholding on

residents (1 percent (.01)) and

wages, vacation allowances, bonuses

this income, these individuals are

nonresidents (0.5 percent (.005)).

and commissions (as defined in the

required to file Albion income tax

Use the 1 percent (.01) rate for:

Federal Employer's Tax Guide,

returns (AL-1040) and report this

1. Albion residents working in Albion,

Circular E, Taxable Wages).

income if they are Albion residents,

and

or are nonresidents earning income

Vacation, holiday, sick and bonus

2. Albion residents working outside of

in Albion.

pay to nonresidents who perform part

the city who are subject to with-

of their work in Albion, is taxable to

holding for another city where they

WITHHOLDING REQUIRED

the same extent as their regular

work.

ON RESIDENTS

wages. For example: George

Use the 0.5 (.005) percent rate for:

Johnson is a nonresident employee

The withholding rate for Albion

who is subject to withholding on 60

residents who are not subject to

1. Nonresidents of Albion working in

percent of his earnings, because 60

withholding in any other city is 1

Albion, and

percent of his work is performed in

percent (.01). This is applied to the

2. Albion residents working outside of

Albion. George is also subject to

total compensation after exemptions.

the city who are also subject to

withholding on 60 percent of his

The withholding rate for residents

withholding for another city in

vacation, holiday, bonus or sick pay.

of Albion whose predominant place of

which they work.

employment is another Michigan city

PAYMENTS NOT SUBJECT

Use the number of exemptions

with an income tax is 0.5 percent

TO WITHHOLDING

claimed by the employee on the

(.005). In addition to withholding half

Withholding does not apply to any of

withholding certificate (AL-W4) to

of one percent for Albion, you must

the following:

find the correct withholding on the

withhold half of one percent for the

table. If an employee refuses to file a

other taxing city in Michigan.

1. Wages paid to domestic help.

withholding certificate, you must

If an Albion resident works for you

2. Compensation paid for professional

withhold 1 percent (.01) from the

in two other cities that have an

services (brokers, etc.), or to any

employee's total compensation without

income tax, you must withhold:

independent contractors.

benefit of exemptions.

1. 0.5 percent (.005) for Albion, the

3. Payments to a nonresident em-

If you prefer to calculate the

city of residence;

ployee for work performed in

withholding directly, use the following

Albion if the employee's predomi-

amounts per exemption:

2. 0.5 percent (.005) for whichever of

nant place of employment is not

the two cities is the predominant

Weekly ......... $11.54

Albion.

place of employment;

Bi-weekly ...... 23.08

4. Payments to a nonresident em-

3. nothing for the 3rd city.

Semi-monthly...25.00

ployee for work performed outside

Monthly ......... 50.00

In no case are you required to

the city.

per diem .......... 1.65

withhold for more than two cities, the

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6