Form Rpd-41171 - Well Workover Project Application And Reporting Instructions

ADVERTISEMENT

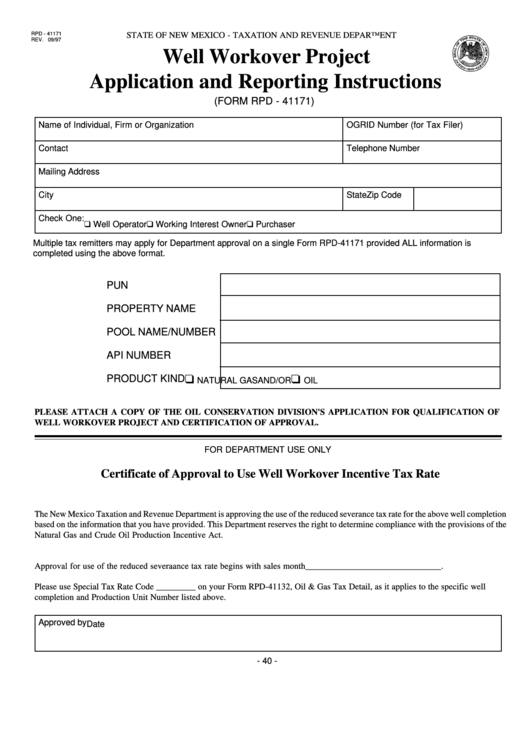

RPD - 41171

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

REV. 09/97

Well Workover Project

Application and Reporting Instructions

(FORM RPD - 41171)

Name of Individual, Firm or Organization

OGRID Number (for Tax Filer)

Contact

Telephone Number

Mailing Address

City

State

Zip Code

Check One:

Well Operator

Working Interest Owner

Purchaser

Multiple tax remitters may apply for Department approval on a single Form RPD-41171 provided ALL information is

completed using the above format.

PUN

PROPERTY NAME

POOL NAME/NUMBER

API NUMBER

PRODUCT KIND

NATURAL GAS

AND/OR

OIL

PLEASE ATTACH A COPY OF THE OIL CONSERVATION DIVISION'S APPLICATION FOR QUALIFICATION OF

WELL WORKOVER PROJECT AND CERTIFICATION OF APPROVAL.

FOR DEPARTMENT USE ONLY

Certificate of Approval to Use Well Workover Incentive Tax Rate

The New Mexico Taxation and Revenue Department is approving the use of the reduced severance tax rate for the above well completion

based on the information that you have provided. This Department reserves the right to determine compliance with the provisions of the

Natural Gas and Crude Oil Production Incentive Act.

Approval for use of the reduced severaance tax rate begins with sales month_______________________________.

Please use Special Tax Rate Code _________ on your Form RPD-41132, Oil & Gas Tax Detail, as it applies to the specific well

completion and Production Unit Number listed above.

Approved by

Date

- 40 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1