Individual Tax Return Form - City Of Cincinnati - 2003

ADVERTISEMENT

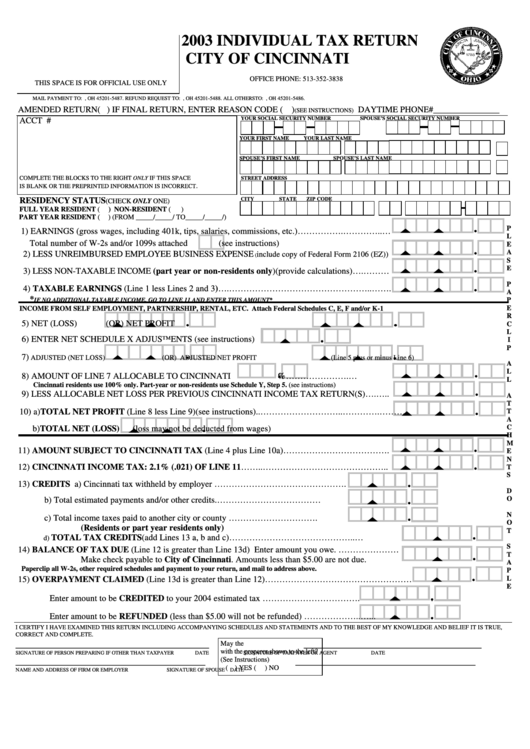

2003 INDIVIDUAL TAX RETURN

CITY OF CINCINNATI

OFFICE PHONE: 513-352-3838

THIS SPACE IS FOR OFFICIAL USE ONLY

MAIL PAYMENT TO: P.O.BOX 5487 CINCINNATI, OH 45201-5487. REFUND REQUEST TO: P.O.BOX 5488 CINCINNATI, OH 45201-5488. ALL OTHERS TO: P.O.BOX 5486 CINCINNATI, OH 45201-5486.

AMENDED RETURN( ) IF FINAL RETURN, ENTER REASON CODE ( )

DAYTIME PHONE#_______________

(SEE INSTRUCTIONS)

YOUR SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

ACCT #

YOUR FIRST NAME

YOUR LAST NAME

M.I.

SPOUSE’S FIRST NAME

SPOUSE’S LAST NAME

M.I.

COMPLETE THE BLOCKS TO THE RIGHT ONLY IF THIS SPACE

STREET ADDRESS

.

IS BLANK OR THE PREPRINTED INFORMATION IS INCORRECT

RESIDENCY STATUS

CITY

STATE

ZIP CODE

(CHECK ONLY ONE)

FULL YEAR RESIDENT (

) NON-RESIDENT (

)

PART YEAR RESIDENT (

) (FROM _____/_____/ TO_____/_____/)

P

1) EARNINGS (gross wages, including 401k, tips, salaries, commissions, etc.)…………….…………..…

L

Total number of W-2s and/or 1099s attached

(see instructions)

E

A

2) LESS UNREIMBURSED EMPLOYEE BUSINESS EXPENSE

include copy of Federal Form 2106 (EZ))

(

S

E

3) LESS NON-TAXABLE INCOME (part year or non-residents only)(provide calculations)….………

P

4) TAXABLE EARNINGS (Line 1 less Lines 2 and 3)….…………………………………………..…….

A

*

P

IF NO ADDITIONAL TAXABLE INCOME, GO TO LINE 11 AND ENTER THIS AMOUNT*

E

INCOME FROM SELF EMPLOYMENT, PARTNERSHIP, RENTAL, ETC. Attach Federal Schedules C, E, F and/or K-1

R

5) NET (LOSS)

(OR) NET PROFIT

C

L

6) ENTER NET SCHEDULE X ADJUSTMENTS (see instructions)

I

P

7)

ADJUSTED (NET LOSS)

(OR) ADJUSTED NET PROFIT

(Line 5 plus or minus Line 6)

A

L

8) AMOUNT OF LINE 7 ALLOCABLE TO CINCINNATI

%………………….…

L

Cincinnati residents use 100% only. Part-year or non-residents use Schedule Y, Step 5. (see instructions)

9) LESS ALLOCABLE NET LOSS PER PREVIOUS CINCINNATI INCOME TAX RETURN(S)….…..

A

T

10) a)TOTAL NET PROFIT (Line 8 less Line 9)(see instructions)..………………………..………….………..

T

A

C

b)TOTAL NET (LOSS)

(loss may not be deducted from wages)

H

M

11) AMOUNT SUBJECT TO CINCINNATI TAX (Line 4 plus Line 10a)……………………………….

E

N

12) CINCINNATI INCOME TAX: 2.1% (.021) OF LINE 11……..……………………………………..

T

S

13) CREDITS a) Cincinnati tax withheld by employer ……………………………………….

D

O

b) Total estimated payments and/or other credits.………………………………

N

c) Total income taxes paid to another city or county ………………………….

O

(Residents or part year residents only)

T

TOTAL TAX CREDITS (add Lines 13 a, b and c) ……………………………………..…

d)

S

14) BALANCE OF TAX DUE (Line 12 is greater than Line 13d) Enter amount you owe. …………………

T

Make check payable to City of Cincinnati. Amounts less than $5.00 are not due.

A

Paperclip all W-2s, other required schedules and payment to your return, and mail to address above.

P

L

15) OVERPAYMENT CLAIMED (Line 13d is greater than Line 12)……………………………………………

E

Enter amount to be CREDITED to your 2004 estimated tax …………………………….

Enter amount to be REFUNDED (less than $5.00 will not be refunded) ………………..…...

I CERTIFY I HAVE EXAMINED THIS RETURN INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE,

CORRECT AND COMPLETE.

_____________________________________

__________________________________

May the C.I.T.B. discuss this return

with the preparer shown to the left?

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

SIGNATURE OF TAXPAYER OR AGENT

DATE

(See Instructions)

_______________________________________

_____________________________________

( ) YES

(

) NO

NAME AND ADDRESS OF FIRM OR EMPLOYER

SIGNATURE OF SPOUSE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1