Form 31-116b - Energy Used For Taxable Purposes Page 2

ADVERTISEMENT

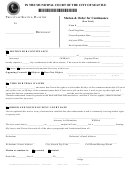

Purchaser:_______________________________

Iowa Sales Tax Computation Certificate

Energy Used That Does Not Qualify For Residential Energy Exemption from Iowa Sales Tax

PERCENTAGE CALCULATION

Complete the calculation below to obtain the percentage of energy used that is subject to Iowa sales tax. Taxable

energy may be for commercial purposes or non-metered energy. Attach documentation as needed.

Period used for basis of computation: _____/_____/_____ to _____/_____/_____

Type of Fuel:________________

(A)

(B)

Taxable

Energy Used

Hours

Total

Activity

(watts/ccf)/hour

of Use

(A x B)

Lighting

x

=

Heating

x

=

Office Equip.

x

=

Refrigeration

x

=

Maintenance

x

=

Air Conditioning

x

=

Other: _________________

x

=

Other: _________________

x

=

Other: _________________

x

=

x

=

Other: _________________

(1) TOTAL SUBJECT TO TAX

(2) TOTAL ENERGY USED FOR ALL PURPOSES

%

(3) TAXABLE % (divide line 1 by line 2)

31-116b (09/21/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2