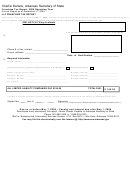

Franchise Tax Computation Worksheet - Kansas Secretary Of State Page 2

ADVERTISEMENT

Instructions

1. Please be sure to enclose a check made payable to the secretary of state with the annual report. Please do not

send cash.

2. Be sure to complete all applicable items to the best of your knowledge. Use zeros and N/A if needed.

3. DUE DATE-Annual reports are due when the Kansas annual income tax report is due, generally the 15th day

of the fourth month following the close of the tax period. State law provides that, in addition to penalties, the

failure to file the annual report or to pay its annual taxes within 90 days of the time for filing and

paying will result in the forfeiture of the corporation in Kansas. The annual report must be filed every year

if the corporation wishes to remain in good standing in Kansas.

4. EXTENSIONS-An extension of the filing deadline may be obtained by submitting a copy of an application for

an extension of time for filing a Kansas or federal income tax return. The request for extension must be filed not

more than 90 days after the due date of the annual report. No payment is necessary until the report is filed.

5. INTERIM REPORT-An interim report must be filed if the tax period changes. The franchise tax for an

interim report can be prorated for the number of months the report covers. However, there is a minimum amount

due of $55. An interim report cannot be filed for a period greater than 12 months from the date of the last report

filed.

6. AMENDED REPORT-If this is an amended report, indicate by printing "amended" at the top of the first page.

Notice: There is a $25 service fee for all returned checks.

Rev. 8/11/03 amc

K.S.A. 17-7503, 17-7505

4/4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2