Form E-5 - Census Of Governments - Survey Of Government Employment - 2007 Page 4

ADVERTISEMENT

E-5

Page 4

(06-23-2006)

DEFINITIONS

Please report figures covering all departments and agencies (except

PAYROLL (GROSS BEFORE DEDUCTIONS) – Salaries, wages, fees,

any school system employment and payrolls) of the government

or commissions earned during (applicable to) the pay period(s) which

named in the address label.

includes March 12, 2007. Include overtime, premium, and night

differential pay. Include bonus and incentive payments that are paid at

If your office records do not contain all the information requested,

regular pay intervals. Include amounts withheld for taxes, employee

please obtain the figures from other agencies for inclusion in this

contributions to retirement systems, etc. Exclude lump sum payments

report. If you cannot supply entirely comprehensive data, list in the

and the value of living quarters and subsistence allowances furnished

remarks section at the end of this questionnaire any agencies of your

to employees. If some employees are on a different pay interval from

government that are not included.

the majority, please report their payroll and any part-time hours

separately as indicated in the Special Instructions for Part III below.

EMPLOYEES – Persons paid for personal services performed in the

indicated pay period, including any persons in a paid leave status.

PART-TIME HOURS PAID – Total hours actually paid during pay

Include officials paid on a salary basis; by fees or commissions; on a

interval for all persons working less than the number of hours that

per meeting basis; or a flat sum quarterly, semiannually, or annually.

represents full-time employment. Include an estimate of hours worked

Employees who have multiple responsibilities should be reported only

during pay interval for part-time employees and officials not

once at the functional classification which is their primary responsibility.

compensated on an hourly basis.

For example, employees in city or county clerk offices may have

financial

administration,

central

administration,

and

judicial

SHERIFF’S OFFICE EMPLOYEES – In addition to reporting

responsibility; these employees and their total gross pay should be

employees and payrolls in “Police protection,” court bailiffs and any

reported only at the one activity which accounts for most of their time.

other court employees should be reported in “Judicial and legal.”

Exclude school system employees, employees on unpaid leave,

unpaid officials, pensioners, and contractors and their employees.

FEE OFFICES – Include employees of fee offices in “Financial

administration.” If information on fee office employees and payrolls is

FULL-TIME EMPLOYEES – Persons employed during the pay period

not available, please note and list the fee offices in “Additional

to work the number of hours per week that represents regular full-time

remarks”.

employment. Include full-time temporary or seasonal employees who

are working the number of hours that represents full-time employment.

EDUCATION EMPLOYEES – Exclude any school system employees

and payrolls from this form. Include any county supervision of public

PART-TIME EMPLOYEES – Persons employed on a part-time basis

school districts in “All other.”

during the designated pay period. Include those daily or hourly

employees usually engaged for less than the regular full-time

workweek, as well as any part-time paid officials. Exclude here, and

report as full-time, any temporary or seasonal employees working on a

full-time basis during the pay period.

EMPLOYEES IN FEDERALLY FUNDED PROGRAMS – Persons paid

from Federal grant funds should be reported as employees of this

government. Report these employees and their pay in the appropriate

functional classification.

GENERAL INSTRUCTIONS

1.

Indicate in Part I the standard weekly hours of work for most full-

6.

Include total paid hours of work for part-time employees in Part

time employees.

III, column (e). If actual hours are not known, please enter an

estimate.

2.

Indicate in Part II the length or frequency of your pay interval.

7.

Use the reporting format shown in SPECIAL INSTRUCTIONS

3.

Include all current employees whether paid from the general fund

FOR PART III if you have multiple pay intervals.

or special funds.

8.

If you are unable to supply any of the information requested in

4.

Include all paid elected or appointed officials.

Part III, please list in Additional remarks the source(s) of the

missing information (including address and telephone number).

5.

Report in Part III gross payroll amounts for just the one pay period

which includes March 12, 2007.

9.

If exact figures are not available, enter estimates and mark with

an asterisk.

a.

Do not report cumulative salaries since the beginning of the

calendar or fiscal year.

10. Complete the DATA SUPPLIED BY box on the front of the form

and return the completed questionnaire in the envelope provided.

b.

Do not report payroll amounts from last fiscal year.

11. Retain a copy of the completed questionnaire for your records.

c.

Do not report the employer costs of non-wage employee

benefits such as workers’ compensation, FICA, health

insurance, etc.

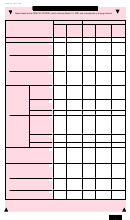

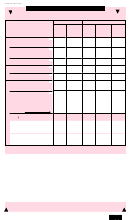

SPECIAL INSTRUCTIONS FOR PART III

Report separately in Part III all employees, payrolls, and part-time

For example, if your government has three (3) full-time employees and

hours that are on a pay interval different from the one reported in Part

three (3) part-time employees and each is paid at different pay

II, PAY INTERVAL. Write a pay interval code M, T, B, W, Q, S, or A

intervals, report data separately as shown in the following example:

next to payroll amounts and part-time hours to indicate applicable pay

interval.

Part III

EMPLOYEES, PAYROLL, AND PART-TIME HOURS

Full-time employees

Part-time employees

Number

Payroll

Number

Payroll

Hours

1

$3,500 (M)

1

$1,100 (B)

114 (B)

1

$550 (W)

2

$10,500 (Q)

1,000 (Q)

1

$20,000 (A)

In this example, $3,500 represents the monthly (code M) amount for 1 full-time employee; $550 represents

the weekly (code W) amount for 1 full-time employee; and $20,000 represents the annual (code A) amount

for 1 full-time employee; and $1,100 represents the biweekly (code B) amount for 1 part-time employee.

$10,500 represents the quarterly (code Q) amount for 2 part-time employees.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4