Instructions For Filing A Claim Form - Federal Emergency Management Agency

ADVERTISEMENT

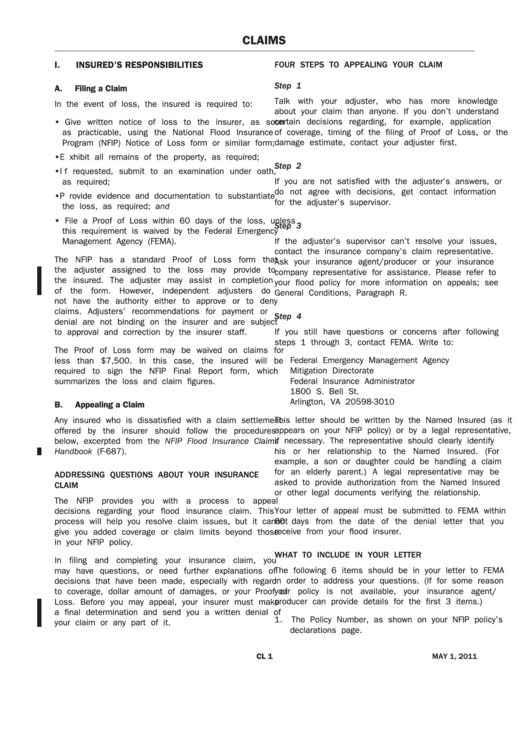

CLAIMS

I. INSURED’S RESPONSIBILITIES

Four steps to appealing your claiM

Step 1

A. Filing a Claim

Talk with your adjuster, who has more knowledge

In the event of loss, the insured is required to:

about your claim than anyone. If you don’t understand

certain decisions regarding, for example, application

• Give written notice of loss to the insurer, as soon

as practicable, using the National Flood Insurance

of coverage, timing of the filing of Proof of Loss, or the

Program (NFIP) Notice of Loss form or similar form;

damage estimate, contact your adjuster first.

• E xhibit all remains of the property, as required;

Step 2

• I f requested, submit to an examination under oath,

as required;

If you are not satisfied with the adjuster’s answers, or

do not agree with decisions, get contact information

• P rovide evidence and documentation to substantiate

for the adjuster’s supervisor.

the loss, as required; and

• File a Proof of Loss within 60 days of the loss, unless

Step 3

this requirement is waived by the Federal Emergency

If the adjuster’s supervisor can’t resolve your issues,

Management Agency (FEMA).

contact the insurance company’s claim representative.

The NFIP has a standard Proof of Loss form that

Ask your insurance agent/producer or your insurance

the adjuster assigned to the loss may provide to

company representative for assistance. Please refer to

the insured. The adjuster may assist in completion

your flood policy for more information on appeals; see

of the form. However, independent adjusters do

General Conditions, Paragraph R.

not have the authority either to approve or to deny

claims. Adjusters’ recommendations for payment or

step 4

denial are not binding on the insurer and are subject

If you still have questions or concerns after following

to approval and correction by the insurer staff.

steps 1 through 3, contact FEMA. Write to:

The Proof of Loss form may be waived on claims for

Federal Emergency Management Agency

less than $7,500. In this case, the insured will be

Mitigation Directorate

required to sign the NFIP Final Report form, which

summarizes the loss and claim figures.

Federal Insurance Administrator

1800 S. Bell St.

Arlington, VA 20598-3010

B. Appealing a Claim

Any insured who is dissatisfied with a claim settlement

This letter should be written by the Named Insured (as it

offered by the insurer should follow the procedures

appears on your NFIP policy) or by a legal representative,

if necessary. The representative should clearly identify

below, excerpted from the NFIP Flood Insurance Claims

his or her relationship to the Named Insured. (For

Handbook (F-687).

example, a son or daughter could be handling a claim

for an elderly parent.) A legal representative may be

addressing Questions about your insurance

asked to provide authorization from the Named Insured

claiM

or other legal documents verifying the relationship.

The NFIP provides you with a process to appeal

decisions regarding your flood insurance claim. This

Your letter of appeal must be submitted to FEMA within

60 days from the date of the denial letter that you

process will help you resolve claim issues, but it cannot

receive from your flood insurer.

give you added coverage or claim limits beyond those

in your NFIP policy.

What to include in your letter

In filing and completing your insurance claim, you

The following 6 items should be in your letter to FEMA

may have questions, or need further explanations of

in order to address your questions. (If for some reason

decisions that have been made, especially with regard

to coverage, dollar amount of damages, or your Proof of

your policy is not available, your insurance agent/

Loss. Before you may appeal, your insurer must make

producer can provide details for the first 3 items.)

a final determination and send you a written denial of

1. � The Policy Number, as shown on your NFIP policy’s

your claim or any part of it.

declarations page.

CL 1

May 1, 2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4