Form 1 (Through 6) - Transmittal Of Financial Reports And Certification Of Compliance With United States Trustee Operating Requirements Page 5

ADVERTISEMENT

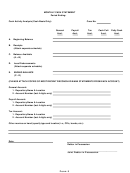

SUMMARY OF OPERATIONS

Period Ended:

Case No:

Schedule of Postpetition Taxes Payable

Beginning

Accrued/

Payments/

Ending

Balance

Withheld

Deposits

Balance

Income Taxes Withheld:

Federal:

State:

Local:

Self Employment Taxes

FICA Withheld:

Employers FICA:

Unemployment Tax:

Federal:

State:

Sales, Use & Excise

Taxes:

Property Taxes:

Workers' Compensation

Other:

TOTALS:

AGING OF ACCOUNTS RECEIVABLE

AND POSTPETITION ACCOUNTS PAYABLE

Age in Days

0-30

30-60

Over 60

Post Petition

Accounts Payable

Accounts Receivable

For all postpetition accounts payable over 30 days old, please attached a sheet listing each such

account, to whom the account is owed, the date the account was opened, and the reason for

non-payment of the account.

Describe events or factors occurring during this reporting period materially affecting operations and

formulation of a Plan of Reorganization:

Form 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8