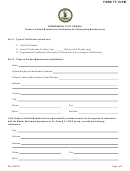

Part 4: Nonparticipating Manufacturer

A. Identification of Directors, Members, Officers, and Owners of the Company:

Interested Party

Nature of Interest

Address

Phone and Fax Numbers

B. Association With Other Tobacco Product Manufacturers

Are any of the individuals or entities identified in Part 4A also directors, members, officers, or owners

of any other tobacco product manufacturers?

Yes

c

No

c

If yes, please explain:

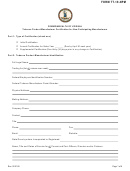

C. Federal Excise Tax Paid

The nonparticipating manufacturer identified in Part 1, must provide the following information:

1.

Total nationwide sales on which federal excise tax was paid in the preceding calendar year __________.

Note: If the manufacturer identified in Part 1 is a domestic tobacco product manufacturer, a copy of the Tobacco

Tax Bureau Form 5210.5 supporting the total sales number must be attached to this Certification.

If the manufacturer identified in Part 1 is a foreign tobacco product manufacturer, a copy of Tobacco Tax Bureau

Form 5220.6 supporting the total sales number must be attached to this Certification.

2. Total nationwide sales reported pursuant to 15 U.S.C. § 376 during the preceding calendar year __________.

Note: Copies of all reports made pursuant to 15 U.S.C. § 376, including reports to states other than Nebraska, shall be

made available to the Nebraska Department of Revenue or Nebraska Attorney General’s Office upon request.

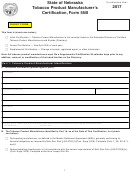

Part 5: Nonparticipating Manufacturer Stamping Agent

Provide the following information for all stamping agents to whom cigarettes and/or roll-your-own tobacco were sold by, or

on behalf of, the nonparticipating manufacturer identified in Part 1 for distribution in Nebraska in the current or preceding

year (attach additional sheets if necessary).

Phone

Number

Name of Stamping Agent

Address

Brand

Note: Stamping Agent is defined in § 69-2706(20) as a person authorized to affix stamps to packages of cigarettes or a

person required to pay the tobacco products tax imposed on roll-your-own tobacco. The nonparticipating manufacturer

shall update this information if it changes during the calendar year.

6

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10