City Of Peoria, Illinois Municipal Tax Return

ADVERTISEMENT

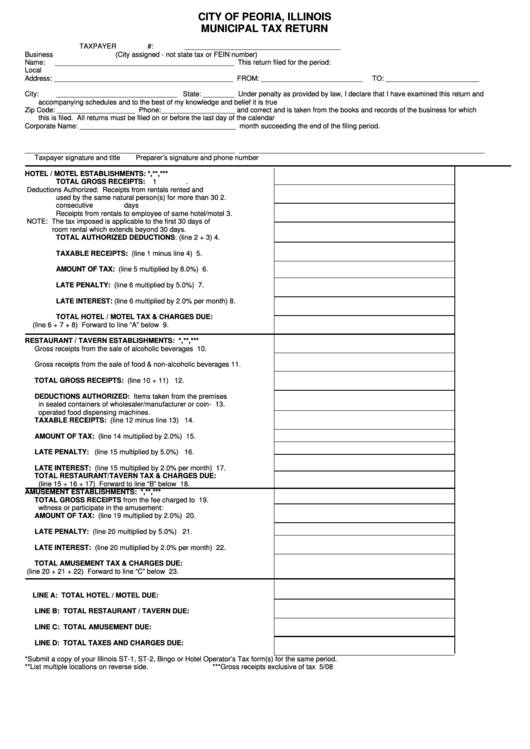

CITY OF PEORIA, ILLINOIS

MUNICIPAL TAX RETURN

TAXPAYER #: ________________________________________

Business

(City assigned - not state tax or FEIN number)

Name:

______________________________________________

This return filed for the period:

Local

Address: ______________________________________________

FROM: __________________________

TO: ________________________

City:

_______________________________ State: ________

Under penalty as provided by law, I declare that I have examined this return and

accompanying schedules and to the best of my knowledge and belief it is true

Zip Code: ____________________ Phone:___________________

and correct and is taken from the books and records of the business for which

this is filed. All returns must be filed on or before the last day of the calendar

Corporate Name: ________________________________________

month succeeding the end of the filing period.

______________________________________________________

_______________________________________________________________

Taxpayer signature and title

Preparer’s signature and phone number

HOTEL / MOTEL ESTABLISHMENTS: *,**,***

TOTAL GROSS RECEIPTS:

1.

Deductions Authorized: Receipts from rentals rented and

used by the same natural person(s) for more than 30

2.

consecutive days

Receipts from rentals to employee of same hotel/motel

3.

NOTE: The tax imposed is applicable to the first 30 days of

room rental which extends beyond 30 days.

TOTAL AUTHORIZED DEDUCTIONS: (line 2 + 3)

4.

TAXABLE RECEIPTS: (line 1 minus line 4)

5.

AMOUNT OF TAX: (line 5 multiplied by 8.0%)

6.

LATE PENALTY: (line 6 multiplied by 5.0%)

7.

LATE INTEREST: (line 6 multiplied by 2.0% per month)

8.

TOTAL HOTEL / MOTEL TAX & CHARGES DUE:

(line 6 + 7 + 8) Forward to line “A” below

9.

RESTAURANT / TAVERN ESTABLISHMENTS: *,**,***

Gross receipts from the sale of alcoholic beverages

10.

Gross receipts from the sale of food & non-alcoholic beverages

11.

TOTAL GROSS RECEIPTS: (line 10 + 11)

12.

DEDUCTIONS AUTHORIZED: Items taken from the premises

in sealed containers of wholesaler/manufacturer or coin-

13.

operated food dispensing machines.

TAXABLE RECEIPTS: (line 12 minus line 13)

14.

AMOUNT OF TAX: (line 14 multiplied by 2.0%)

15.

LATE PENALTY: (line 15 multiplied by 5.0%)

16.

LATE INTEREST: (line 15 multiplied by 2.0% per month)

17.

TOTAL RESTAURANT/TAVERN TAX & CHARGES DUE:

(line 15 + 16 + 17) Forward to line “B” below

18.

AMUSEMENT ESTABLISHMENTS: *,**,***

TOTAL GROSS RECEIPTS from the fee charged to

19.

witness or participate in the amusement:

AMOUNT OF TAX: (line 19 multiplied by 2.0%)

20.

LATE PENALTY: (line 20 multiplied by 5.0%)

21.

LATE INTEREST: (line 20 multiplied by 2.0% per month)

22.

TOTAL AMUSEMENT TAX & CHARGES DUE:

(line 20 + 21 + 22) Forward to line “C” below

23.

LINE A:

TOTAL HOTEL / MOTEL DUE:

LINE B:

TOTAL RESTAURANT / TAVERN DUE:

LINE C:

TOTAL AMUSEMENT DUE:

LINE D:

TOTAL TAXES AND CHARGES DUE:

*Submit a copy of your Illinois ST-1, ST-2, Bingo or Hotel Operator’s Tax form(s) for the same period.

**List multiple locations on reverse side.

***Gross receipts exclusive of tax

5/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2