7

Schedule A (Form 990 or 990-EZ) 2017

Page

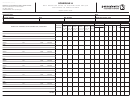

Part V

Type III Non-Functionally Integrated 509(a)(3) Supporting Organizations (continued)

Section D - Distributions

Current Year

1

Amounts paid to supported organizations to accomplish exempt purposes

2

Amounts paid to perform activity that directly furthers exempt purposes of supported

organizations, in excess of income from activity

3

Administrative expenses paid to accomplish exempt purposes of supported organizations

4

Amounts paid to acquire exempt-use assets

5

Qualified set-aside amounts (prior IRS approval required)

6

Other distributions (describe in Part VI). See instructions.

7

Total annual distributions. Add lines 1 through 6.

8

Distributions to attentive supported organizations to which the organization is responsive

(provide details in Part VI). See instructions.

9

Distributable amount for 2017 from Section C, line 6

10

Line 8 amount divided by line 9 amount

(ii)

(iii)

(i)

Section E - Distribution Allocations (see instructions)

Underdistributions

Distributable

Excess Distributions

Pre-2017

Amount for 2017

1

Distributable amount for 2017 from Section C, line 6

2

Underdistributions, if any, for years prior to 2017

(reasonable cause required—explain in Part VI). See

instructions.

3

Excess distributions carryover, if any, to 2017

a

b From 2013

.

.

.

.

.

c From 2014

.

.

.

.

.

d From 2015

.

.

.

.

.

e From 2016

.

.

.

.

.

f

Total of lines 3a through e

g Applied to underdistributions of prior years

h Applied to 2017 distributable amount

i

Carryover from 2012 not applied (see instructions)

j

Remainder. Subtract lines 3g, 3h, and 3i from 3f.

4

Distributions for 2017 from

Section D, line 7:

$

a Applied to underdistributions of prior years

b Applied to 2017 distributable amount

c Remainder. Subtract lines 4a and 4b from 4.

5

Remaining underdistributions for years prior to 2017, if

any. Subtract lines 3g and 4a from line 2. For result

greater than zero, explain in Part VI. See instructions.

6

Remaining underdistributions for 2017. Subtract lines 3h

and 4b from line 1. For result greater than zero, explain in

Part VI. See instructions.

7

Excess distributions carryover to 2018. Add lines 3j

and 4c.

8

Breakdown of line 7:

a Excess from 2013

.

.

.

b Excess from 2014 .

.

.

c Excess from 2015 .

.

.

d Excess from 2016 .

.

.

e Excess from 2017 .

.

.

Schedule A (Form 990 or 990-EZ) 2017

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8