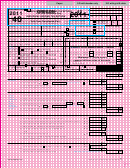

Tax Tables For Form 40 (Oregon Income Tax) - 2015 Page 3

ADVERTISEMENT

2015 Tax Tables

Use column J if you are:

S

J

Use column S if you are:

• Married filing jointly

• Single

for Form 40

• Head of household

• Married filing separately

• Widow(er) with dependent child

If income from

If income from

If income from

If income from

Form 40,

And you

Form 40,

And you

Form 40,

And you

Form 40,

And you

line 21 is:

use column:

line 21 is:

use column:

line 21 is:

use column:

line 21 is:

use column:

S J

S J

S J

S J

But

But

But

But

At

less

At

less

At

less

At

less

least:

than:

least:

than:

least:

than:

least:

than:

Your tax is:

Your tax is:

Your tax is:

Your tax is:

$ 39,000

$ 42,000

$ 45,000

$ 48,000

39,000 – 39,100 3,280 3,045

42,000 – 42,100 3,550 3,315

45,000 – 45,100 3,820 3,585

48,000 – 48,100 4,090 3,855

39,100 – 39,200 3,289 3,054

42,100 – 42,200 3,559 3,324

45,100 – 45,200 3,829 3,594

48,100 – 48,200 4,099 3,864

39,200 – 39,300 3,298 3,063

42,200 – 42,300 3,568 3,333

45,200 – 45,300 3,838 3,603

48,200 – 48,300 4,108 3,873

39,300 – 39,400 3,307 3,072

42,300 – 42,400 3,577 3,342

45,300 – 45,400 3,847 3,612

48,300 – 48,400 4,117 3,882

39,400 – 39,500 3,316 3,081

42,400 – 42,500 3,586 3,351

45,400 – 45,500 3,856 3,621

48,400 – 48,500 4,126 3,891

39,500 – 39,600 3,325 3,090

42,500 – 42,600 3,595 3,360

45,500 – 45,600 3,865 3,630

48,500 – 48,600 4,135 3,900

39,600 – 39,700 3,334 3,099

42,600 – 42,700 3,604 3,369

45,600 – 45,700 3,874 3,639

48,600 – 48,700 4,144 3,909

39,700 – 39,800 3,343 3,108

42,700 – 42,800 3,613 3,378

45,700 – 45,800 3,883 3,648

48,700 – 48,800 4,153 3,918

39,800 – 39,900 3,352 3,117

42,800 – 42,900 3,622 3,387

45,800 – 45,900 3,892 3,657

48,800 – 48,900 4,162 3,927

39,900 – 40,000 3,361 3,126

42,900 – 43,000 3,631 3,396

45,900 – 46,000 3,901 3,666

48,900 – 49,000 4,171 3,936

$ 40,000

$ 43,000

$ 46,000

$ 49,000

40,000 – 40,100 3,370 3,135

43,000 – 43,100 3,640 3,405

46,000 – 46,100 3,910 3,675

49,000 – 49,100 4,180 3,945

40,100 – 40,200 3,379 3,144

43,100 – 43,200 3,649 3,414

46,100 – 46,200 3,919 3,684

49,100 – 49,200 4,189 3,954

40,200 – 40,300 3,388 3,153

43,200 – 43,300 3,658 3,423

46,200 – 46,300 3,928 3,693

49,200 – 49,300 4,198 3,963

40,300 – 40,400 3,397 3,162

43,300 – 43,400 3,667 3,432

46,300 – 46,400 3,937 3,702

49,300 – 49,400 4,207 3,972

40,400 – 40,500 3,406 3,171

43,400 – 43,500 3,676 3,441

46,400 – 46,500 3,946 3,711

49,400 – 49,500 4,216 3,981

40,500 – 40,600 3,415 3,180

43,500 – 43,600 3,685 3,450

46,500 – 46,600 3,955 3,720

49,500 – 49,600 4,225 3,990

40,600 – 40,700 3,424 3,189

43,600 – 43,700 3,694 3,459

46,600 – 46,700 3,964 3,729

49,600 – 49,700 4,234 3,999

40,700 – 40,800 3,433 3,198

43,700 – 43,800 3,703 3,468

46,700 – 46,800 3,973 3,738

49,700 – 49,800 4,243 4,008

40,800 – 40,900 3,442 3,207

43,800 – 43,900 3,712 3,477

46,800 – 46,900 3,982 3,747

49,800 – 49,900 4,252 4,017

40,900 – 41,000 3,451 3,216

43,900 – 44,000 3,721 3,486

46,900 – 47,000 3,991 3,756

49,900 – 50,000 4,261 4,026

$ 41,000

$ 44,000

$ 47,000

41,000 – 41,100 3,460 3,225

44,000 – 44,100 3,730 3,495

47,000 – 47,100 4,000 3,765

41,100 – 41,200 3,469 3,234

44,100 – 44,200 3,739 3,504

47,100 – 47,200 4,009 3,774

41,200 – 41,300 3,478 3,243

44,200 – 44,300 3,748 3,513

47,200 – 47,300 4,018 3,783

41,300 – 41,400 3,487 3,252

44,300 – 44,400 3,757 3,522

47,300 – 47,400 4,027 3,792

41,400 – 41,500 3,496 3,261

44,400 – 44,500 3,766 3,531

47,400 – 47,500 4,036 3,801

41,500 – 41,600 3,505 3,270

44,500 – 44,600 3,775 3,540

47,500 – 47,600 4,045 3,810

41,600 – 41,700 3,514 3,279

44,600 – 44,700 3,784 3,549

47,600 – 47,700 4,054 3,819

41,700 – 41,800 3,523 3,288

44,700 – 44,800 3,793 3,558

47,700 – 47,800 4,063 3,828

41,800 – 41,900 3,532 3,297

44,800 – 44,900 3,802 3,567

47,800 – 47,900 4,072 3,837

41,900 – 42,000 3,541 3,306

44,900 – 45,000 3,811 3,576

47,900 – 48,000 4,081 3,846

2015 Tax rate charts

Chart S: For persons filing single or married/RDP filing separately—

If your taxable income is over $50,000 but not over $125,000 ..............your tax is $4,265 plus 9% of excess over $50,000

If your taxable income is over $125,000 ............................................your tax is $11,015 plus 9.9% of excess over $125,000

Chart J: For persons filing jointly, head of household, or qualifying widow(er) with dependent child—

If your taxable income is over $50,000 but not over $250,000 ..............your tax is $4,030 plus 9% of excess over $50,000

If your taxable income is over $250,000 ............................................your tax is $22,030 plus 9.9% of excess over $250,000

29

150-101-043 (Rev. 12-15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3