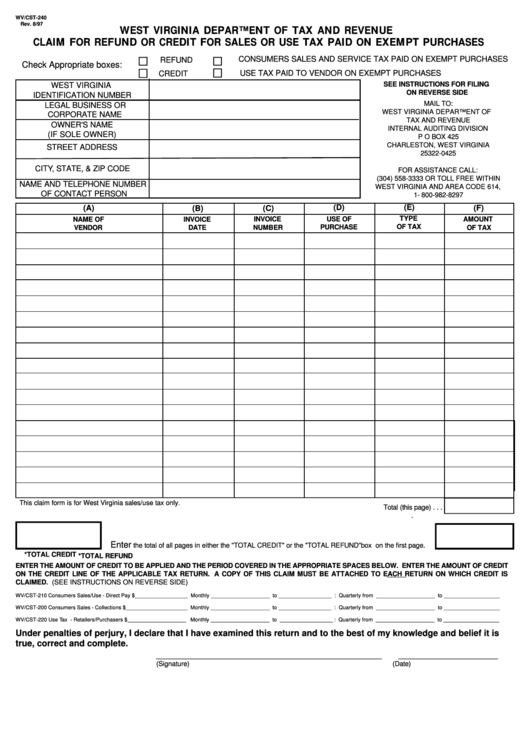

WV/CST-240

Rev. 8/97

WEST VIRGINIA DEPARTMENT OF TAX AND REVENUE

CLAIM FOR REFUND OR CREDIT FOR SALES OR USE TAX PAID ON EXEMPT PURCHASES

CONSUMERS SALES AND SERVICE TAX PAID ON EXEMPT PURCHASES

REFUND

Check Appropriate boxes:

USE TAX PAID TO VENDOR ON EXEMPT PURCHASES

CREDIT

SEE INSTRUCTIONS FOR FILING

WEST VIRGINIA

ON REVERSE SIDE

IDENTIFICATION NUMBER

MAIL TO:

LEGAL BUSINESS OR

WEST VIRGINIA DEPARTMENT OF

CORPORATE NAME

TAX AND REVENUE

OWNER'S NAME

INTERNAL AUDITING DIVISION

(IF SOLE OWNER)

P O BOX 425

CHARLESTON, WEST VIRGINIA

STREET ADDRESS

25322-0425

CITY, STATE, & ZIP CODE

FOR ASSISTANCE CALL:

(304) 558-3333 OR TOLL FREE WITHIN

NAME AND TELEPHONE NUMBER

WEST VIRGINIA AND AREA CODE 614,

OF CONTACT PERSON

1- 800-982-8297

(D)

(E)

(A)

(C)

(F)

(B)

USE OF

TYPE

NAME OF

INVOICE

INVOICE

AMOUNT

OF TAX

NUMBER

PURCHASE

VENDOR

DATE

OF TAX

This claim form is for West Virginia sales/use tax only.

Total (this page) . . .

.

Enter

the total of all pages in either the "TOTAL CREDIT" or the "TOTAL REFUND"box on the first page.

*TOTAL CREDIT

*TOTAL REFUND

ENTER THE AMOUNT OF CREDIT TO BE APPLIED AND THE PERIOD COVERED IN THE APPROPRIATE SPACES BELOW. ENTER THE AMOUNT OF CREDIT

ON THE CREDIT LINE OF THE APPLICABLE TAX RETURN. A COPY OF THIS CLAIM MUST BE ATTACHED TO EACH RETURN ON WHICH CREDIT IS

CLAIMED. (SEE INSTRUCTIONS ON REVERSE SIDE)

WV/CST-210 Consumers Sales/Use - Direct Pay $__________________ Monthly ____________________ to __________________ : Quarterly from ____________________ to ___________________

WV/CST-200 Consumers Sales - Collections $_____________________ Monthly ____________________ to __________________ : Quarterly from ____________________ to ___________________

WV/CST-220 Use Tax - Retailers/Purchasers $____________________ Monthly ____________________ to __________________ : Quarterly from ____________________ to ___________________

Under penalties of perjury, I declare that I have examined this return and to the best of my knowledge and belief it is

true, correct and complete.

___________________________________________________________

__________________________

(Signature)

(Date)

1

1