Form 7018 - Employer'S Order Blank For Forms

ADVERTISEMENT

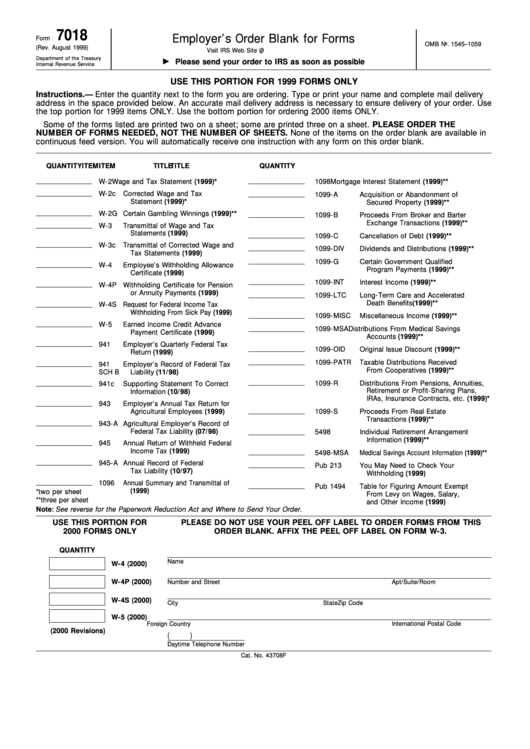

7018

Employer’s Order Blank for Forms

Form

OMB No. 1545–1059

(Rev. August 1999)

Visit IRS Web Site @

Department of the Treasury

Please send your order to IRS as soon as possible

Internal Revenue Service

USE THIS PORTION FOR 1999 FORMS ONLY

Instructions.— Enter the quantity next to the form you are ordering. Type or print your name and complete mail delivery

address in the space provided below. An accurate mail delivery address is necessary to ensure delivery of your order. Use

the top portion for 1999 items ONLY. Use the bottom portion for ordering 2000 items ONLY.

Some of the forms listed are printed two on a sheet; some are printed three on a sheet. PLEASE ORDER THE

NUMBER OF FORMS NEEDED, NOT THE NUMBER OF SHEETS. None of the items on the order blank are available in

continuous feed version. You will automatically receive one instruction with any form on this order blank.

QUANTITY

ITEM

TITLE

QUANTITY

ITEM

TITLE

W-2

Wage and Tax Statement (1999)*

1098

Mortgage Interest Statement (1999)**

W-2c

Corrected Wage and Tax

1099-A

Acquisition or Abandonment of

Statement (1999)*

Secured Property (1999)**

W-2G

Certain Gambling Winnings (1999)**

1099-B

Proceeds From Broker and Barter

Exchange Transactions (1999)**

W-3

Transmittal of Wage and Tax

Statements (1999)

1099-C

Cancellation of Debt (1999)**

W-3c

Transmittal of Corrected Wage and

1099-DIV

Dividends and Distributions (1999)**

Tax Statements (1999)

1099-G

Certain Government Qualified

W-4

Employee’s Withholding Allowance

Program Payments (1999)**

Certificate (1999)

1099-INT

Interest Income (1999)**

W-4P

Withholding Certificate for Pension

or Annuity Payments (1999)

1099-LTC

Long-Term Care and Accelerated

Death Benefits(1999)**

W-4S

Request for Federal Income Tax

Withholding From Sick Pay (1999)

1099-MISC

Miscellaneous Income (1999)**

W-5

Earned Income Credit Advance

1099-MSA

Distributions From Medical Savings

Payment Certificate (1999)

Accounts (1999)**

941

Employer’s Quarterly Federal Tax

1099-OID

Original Issue Discount (1999)**

Return (1999)

1099-PATR

Taxable Distributions Received

941

Employer’s Record of Federal Tax

From Cooperatives (1999)**

SCH B

Liability (11/98)

1099-R

Distributions From Pensions, Annuities,

941c

Supporting Statement To Correct

Retirement or Profit-Sharing Plans,

Information (10/98)

IRAs, Insurance Contracts, etc. (1999)*

943

Employer’s Annual Tax Return for

Agricultural Employees (1999)

1099-S

Proceeds From Real Estate

Transactions (1999)**

943-A

Agricultural Employer’s Record of

Federal Tax Liability (07/98)

5498

Individual Retirement Arrangement

Information (1999)**

945

Annual Return of Withheld Federal

Income Tax (1999)

5498-MSA

Medical Savings Account Information (1999)**

945-A

Annual Record of Federal

Pub 213

You May Need to Check Your

Tax Liability (10/97)

Withholding (1999)

1096

Annual Summary and Transmittal of

Pub 1494

Table for Figuring Amount Exempt

U.S. Information Returns (1999)

*two per sheet

From Levy on Wages, Salary,

**three per sheet

and Other Income (1999)

Note: See reverse for the Paperwork Reduction Act and Where to Send Your Order.

USE THIS PORTION FOR

PLEASE DO NOT USE YOUR PEEL OFF LABEL TO ORDER FORMS FROM THIS

2000 FORMS ONLY

ORDER BLANK. AFFIX THE PEEL OFF LABEL ON FORM W-3.

QUANTITY

Name

W-4 (2000)

W-4P (2000)

Number and Street

Apt/Suite/Room

W-4S (2000)

City

State

Zip Code

W-5 (2000)

Foreign Country

International Postal Code

(2000 Revisions)

(

)

Daytime Telephone Number

Cat. No. 43708F

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1