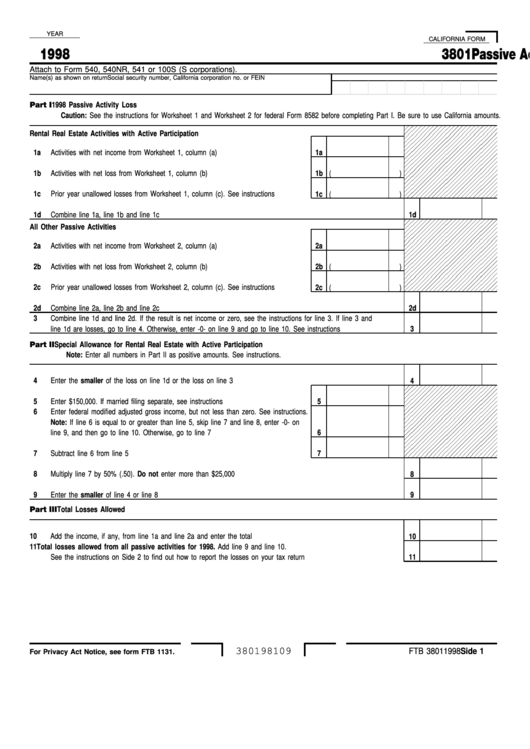

YEAR

CALIFORNIA FORM

1998

Passive Activity Loss Limitations

3801

Attach to Form 540, 540NR, 541 or 100S (S corporations).

Name(s) as shown on return

Social security number, California corporation no. or FEIN

Part I

1998 Passive Activity Loss

Caution: See the instructions for Worksheet 1 and Worksheet 2 for federal Form 8582 before completing Part I. Be sure to use California amounts.

Rental Real Estate Activities with Active Participation

1a

Activities with net income from Worksheet 1, column (a) . . . . . . . . . . . . . . . . . .

1a

1b

Activities with net loss from Worksheet 1, column (b). . . . . . . . . . . . . . . . . . . .

1b

(

)

1c

Prior year unallowed losses from Worksheet 1, column (c). See instructions . . . . . . .

1c

(

)

1d

Combine line 1a, line 1b and line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1d

All Other Passive Activities

2a

Activities with net income from Worksheet 2, column (a) . . . . . . . . . . . . . . . . . .

2a

2b

Activities with net loss from Worksheet 2, column (b). . . . . . . . . . . . . . . . . . . .

2b

(

)

2c

Prior year unallowed losses from Worksheet 2, column (c). See instructions . . . . . . .

2c

(

)

2d

Combine line 2a, line 2b and line 2c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2d

3

Combine line 1d and line 2d. If the result is net income or zero, see the instructions for line 3. If line 3 and

line 1d are losses, go to line 4. Otherwise, enter -0- on line 9 and go to line 10. See instructions . . . . . . . . . . . .

3

Special Allowance for Rental Real Estate with Active Participation

Part II

Note: Enter all numbers in Part II as positive amounts. See instructions.

4

Enter the smaller of the loss on line 1d or the loss on line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Enter $150,000. If married filing separate, see instructions. . . . . . . . . . . . . . . . .

5

6

Enter federal modified adjusted gross income, but not less than zero. See instructions.

Note: If line 6 is equal to or greater than line 5, skip line 7 and line 8, enter -0- on

line 9, and then go to line 10. Otherwise, go to line 7 . . . . . . . . . . . . . . . . . . .

6

7

Subtract line 6 from line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8

Multiply line 7 by 50% (.50). Do not enter more than $25,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

Enter the smaller of line 4 or line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

Part III

Total Losses Allowed

10

Add the income, if any, from line 1a and line 2a and enter the total . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

Total losses allowed from all passive activities for 1998. Add line 9 and line 10.

See the instructions on Side 2 to find out how to report the losses on your tax return . . . . . . . . . . . . . . . . . . .

11

380198109

FTB 3801 1998 Side 1

For Privacy Act Notice, see form FTB 1131.

1

1 2

2 3

3 4

4