C1

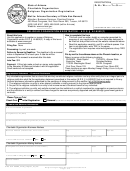

CHARITABLE ORGANIZATION INITIAL REGISTRATION FORM

(Continued)

7. What is the organization’s tax-exempt status?

501(c)_______

Status Pending

Not Tax-Exempt

If the organization’s tax-exempt status is pending, identify the date the organization submitted Form 1023

to the Internal Revenue Service: __________________________________

8. Does the organization use a fiscal agent?

Yes

No

If yes, identify fiscal agent’s name, address, and Federal EIN:____________________________________

______________________________________________________________________________________

9. Address of principal office in Minnesota, or, if none, the name and address of the person who has custody

of books and records:

______________________________________________________________________________________

Contact Person

Phone Number

Email Address

______________________________________________________________________________________________________

Street Address

City, State, and Zip Code

10. Explain in detail the organization’s charitable purpose(s) (attach explanation if more space is needed):

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

11. What methods of solicitation does the organization anticipate using? Check all that apply.

Telemarketing

Publication/Magazine

Show/Concert/Event

Direct Mail

Email

Discount Coupons

Door-to-Door Solicitation

Website

Radio

Thrift Store

Social Media

Vehicle Donations

Other (describe): ________________________________________________

12. Total amount of contributions the organization anticipates receiving from Minnesota donors: $_________

13. Has the organization been denied the right to solicit contributions by any court or government agency?

Yes

No If yes, attach explanation.

14. Does the organization use the services of a professional fundraiser (outside solicitor or consultant) to

solicit contributions in Minnesota?

Yes

No

If yes, provide the following information for each (attach list if more space is needed):

__________________________________________________________________________________

Name of Professional Fundraiser

Compensation

__________________________________________________________________________________

Street Address

City, State, and Zip Code

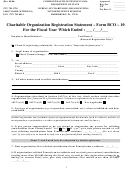

4

1

1 2

2 3

3 4

4