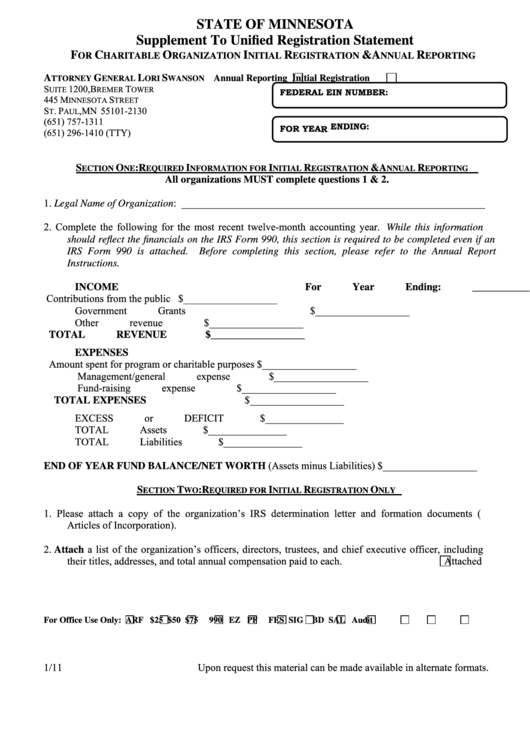

STATE OF MINNESOTA

Supplement To Unified Registration Statement

F

C

O

I

R

& A

R

OR

HARITABLE

RGANIZATION

NITIAL

EGISTRATION

NNUAL

EPORTING

A

G

L

S

Annual Reporting

Initial Registration

TTORNEY

ENERAL

ORI

WANSON

S

1200, B

T

UITE

REMER

OWER

FEDERAL EIN NUMBER:

445 M

S

INNESOTA

TREET

S

. P

, MN 55101-2130

T

AUL

(651) 757-1311

FOR YEAR ENDING:

(651) 296-1410 (TTY)

S

O

: R

I

I

R

& A

R

ECTION

NE

EQUIRED

NFORMATION FOR

NITIAL

EGISTRATION

NNUAL

EPORTING

All organizations MUST complete questions 1 & 2.

1.

Legal Name of Organization: __________________________________________________________

2.

Complete the following for the most recent twelve-month accounting year. While this information

should reflect the financials on the IRS Form 990, this section is required to be completed even if an

IRS Form 990 is attached.

Before completing this section, please refer to the Annual Report

Instructions.

INCOME

For Year Ending: _____________________

Contributions from the public

$__________________

Government Grants

$__________________

Other revenue

$__________________

TOTAL REVENUE

$__________________

EXPENSES

Amount spent for program or charitable purposes

$__________________

Management/general expense

$__________________

Fund-raising expense

$__________________

$__________________

TOTAL EXPENSES

EXCESS or DEFICIT

$_______________

TOTAL Assets

$_______________

TOTAL Liabilities

$_______________

END OF YEAR FUND BALANCE/NET WORTH (Assets minus Liabilities) $__________________

S

T

: R

I

R

O

ECTION

WO

EQUIRED FOR

NITIAL

EGISTRATION

NLY

1.

Please attach a copy of the organization’s IRS determination letter and formation documents (i.e.

Articles of Incorporation).

2.

Attach a list of the organization’s officers, directors, trustees, and chief executive officer, including

their titles, addresses, and total annual compensation paid to each.

Attached

For Office Use Only:

ARF

$25

$50

$75

990

EZ

PF

FES

SIG

BD

SAL

Audit

1/11

Upon request this material can be made available in alternate formats.

1

1 2

2 3

3 4

4