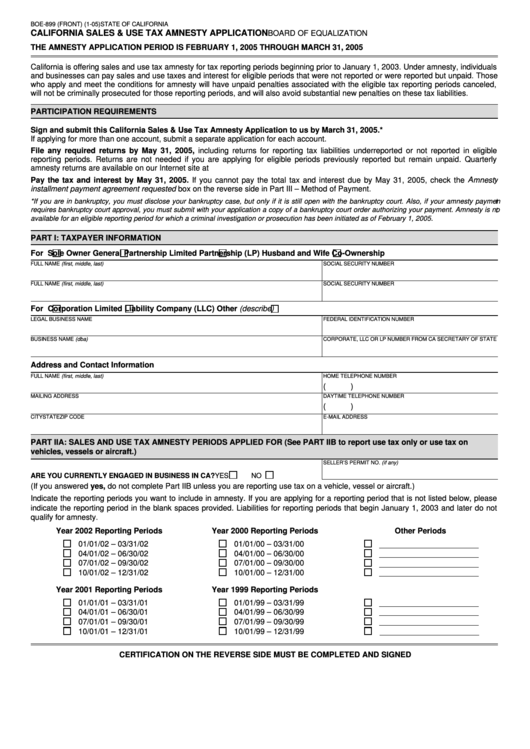

BOE-899 (FRONT) (1-05)

STATE OF CALIFORNIA

CALIFORNIA SALES & USE TAX AMNESTY APPLICATION

BOARD OF EQUALIZATION

THE AMNESTY APPLICATION PERIOD IS FEBRUARY 1, 2005 THROUGH MARCH 31, 2005

California is offering sales and use tax amnesty for tax reporting periods beginning prior to January 1, 2003. Under amnesty, individuals

and businesses can pay sales and use taxes and interest for eligible periods that were not reported or were reported but unpaid. Those

who apply and meet the conditions for amnesty will have unpaid penalties associated with the eligible tax reporting periods canceled,

will not be criminally prosecuted for those reporting periods, and will also avoid substantial new penalties on these tax liabilities.

PARTICIPATION REQUIREMENTS

Sign and submit this California Sales & Use Tax Amnesty Application to us by March 31, 2005.*

If applying for more than one account, submit a separate application for each account.

File any required returns by May 31, 2005, including returns for reporting tax liabilities underreported or not reported in eligible

reporting periods. Returns are not needed if you are applying for eligible periods previously reported but remain unpaid. Quarterly

amnesty returns are available on our Internet site at

Pay the tax and interest by May 31, 2005. If you cannot pay the total tax and interest due by May 31, 2005, check the Amnesty

installment payment agreement requested box on the reverse side in Part III – Method of Payment.

*If you are in bankruptcy, you must disclose your bankruptcy case, but only if it is still open with the bankruptcy court. Also, if your amnesty payment

requires bankruptcy court approval, you must submit with your application a copy of a bankruptcy court order authorizing your payment. Amnesty is not

available for an eligible reporting period for which a criminal investigation or prosecution has been initiated as of February 1, 2005.

PART I: TAXPAYER INFORMATION

For

Sole Owner

General Partnership

Limited Partnership (LP)

Husband and Wife Co-Ownership

FULL NAME (first, middle, last)

SOCIAL SECURITY NUMBER

FULL NAME (first, middle, last)

SOCIAL SECURITY NUMBER

For

Corporation

Limited Liability Company (LLC)

Other (describe)

LEGAL BUSINESS NAME

FEDERAL IDENTIFICATION NUMBER

BUSINESS NAME (dba)

CORPORATE, LLC OR LP NUMBER FROM CA SECRETARY OF STATE

Address and Contact Information

FULL NAME (first, middle, last)

HOME TELEPHONE NUMBER

(

)

MAILING ADDRESS

DAYTIME TELEPHONE NUMBER

(

)

CITY

STATE

ZIP CODE

E-MAIL ADDRESS

PART IIA: SALES AND USE TAX AMNESTY PERIODS APPLIED FOR (See PART IIB to report use tax only or use tax on

vehicles, vessels or aircraft.)

SELLER’S PERMIT NO. (if any)

ARE YOU CURRENTLY ENGAGED IN BUSINESS IN CA?

YES

NO

(If you answered yes, do not complete Part IIB unless you are reporting use tax on a vehicle, vessel or aircraft.)

Indicate the reporting periods you want to include in amnesty. If you are applying for a reporting period that is not listed below, please

indicate the reporting period in the blank spaces provided. Liabilities for reporting periods that begin January 1, 2003 and later do not

qualify for amnesty.

Year 2002 Reporting Periods

Year 2000 Reporting Periods

Other Periods

01/01/02 – 03/31/02

01/01/00 – 03/31/00

04/01/02 – 06/30/02

04/01/00 – 06/30/00

07/01/02 – 09/30/02

07/01/00 – 09/30/00

10/01/02 – 12/31/02

10/01/00 – 12/31/00

Year 2001 Reporting Periods

Year 1999 Reporting Periods

01/01/01 – 03/31/01

01/01/99 – 03/31/99

04/01/01 – 06/30/01

04/01/99 – 06/30/99

07/01/01 – 09/30/01

07/01/99 – 09/30/99

10/01/01 – 12/31/01

10/01/99 – 12/31/99

CERTIFICATION ON THE REVERSE SIDE MUST BE COMPLETED AND SIGNED

1

1 2

2