Form Am-2 - New York State Tax Amnesty Application

ADVERTISEMENT

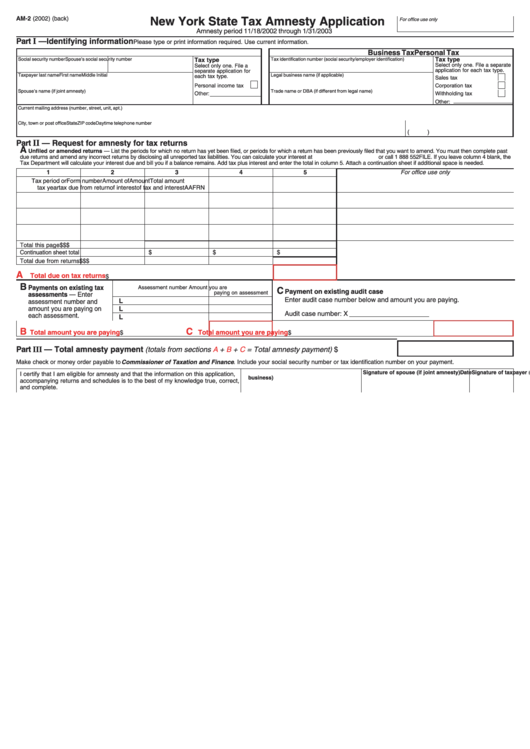

AM-2 (2002) (back)

New York State Tax Amnesty Application

For office use only

Amnesty period 11/18/2002 through 1/31/2003

Part

I

— Identifying information

Please type or print information required. Use current information.

Personal Tax

Business Tax

Tax type

Social security number

Spouse’s social security number

Tax identification number (social security/employer identification)

Tax type

Select only one. File a separate

Select only one. File a

application for each tax type.

separate application for

Taxpayer last name

First name

Middle Initial

Legal business name (if applicable)

each tax type.

Sales tax

Personal income tax

Corporation tax

Spouse’s name (if joint amnesty)

Trade name or DBA (if different from legal name)

Other:

Withholding tax

Other:

Current mailing address (number, street, unit, apt.)

City, town or post office

State

ZIP code

Daytime telephone number

(

)

Part

II

— Request for amnesty for tax returns

A

Unfiled or amended returns — List the periods for which no return has yet been filed, or periods for which a return has been previously filed that you want to amend. You must then complete past

due returns and amend any incorrect returns by disclosing all unreported tax liabilities. You can calculate your interest at or call 1 888 552FILE. If you leave column 4 blank, the

Tax Department will calculate your interest due and bill you if a balance remains. Add tax plus interest and enter the total in column 5. Attach a continuation sheet if additional space is needed.

For office use only

1

2

3

4

5

Tax period or

Form number

Amount of

Amount

Total amount

tax year

tax due from return

of interest

of tax and interest

AA

FRN

Total this page

$

$

$

Continuation sheet total

$

$

$

Total due from returns

$

$

$

A

Total due on tax returns

$

B

Payments on existing tax

Assessment number

Amount you are

C

Payment on existing audit case

paying on assessment

assessments — Enter

Enter audit case number below and amount you are paying.

L

assessment number and

amount you are paying on

L

Audit case number: X

each assessment.

L

B

C

Total amount you are paying

$

Total amount you are paying

$

Part III — Total amnesty payment

..........................

(totals from sections

A

+

B

+

C

= Total amnesty payment)

$

Make check or money order payable to Commissioner of Taxation and Finance . Include your social security number or tax identification number on your payment.

Signature of taxpayer (and title/capacity, if

Signature of spouse (if joint amnesty)

Date

I certify that I am eligible for amnesty and that the information on this application,

business)

accompanying returns and schedules is to the best of my knowledge true, correct,

and complete.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1