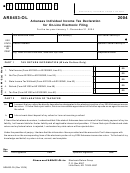

Form Ar8453-Ol - Arkansas Individual Income Tax Declaration For On-Line Electronic Filing - 2004 Page 2

ADVERTISEMENT

Special Information

Mailing Instructions

Direct Deposit will be offered on Electronically Filed Arkansas

The AR8453-OL and attachments (W-2’s, 1099’s and any addi-

Individual Income Tax returns. This is restricted to taxpayers that

tional required schedules) must be mailed to the Department of

will receive a Federal refund. You must use the same account

Finance and Administration on the next working day after you

that is being used for the Federal refund Direct Deposit.

have received your State Acknowledgment from your on-line ser-

vice provider and/or transmitter that the State has accepted your

Declaration Control Number (DCN)

electronically filed return.

Where to Mail

The DCN is a 14 digit number assigned to your return by your on-

line service provider and/or transmitter. Clearly type or print the

DCN in the top left hand corner of Form AR8453-OL. The first two

1. If you are mailing the AR8453-OL with just copies of W-2 and/or

digits are always “00”. The next six digits are the electronic filer

1099 forms, mail to:

identification number (EFIN). The next five digits are the batch

number and serial number. The “5” represents the year the re-

Arkansas Electronic Filing Group

turn is filed (2005).

P. O. 8067

Little Rock, AR 72203-8067

Example. The EFIN is 710001. The batch number is 000. The

serial number is 56. The DCN is 00-710001-00056-5.

If you have a tax due return, do not mail your payment with the

AR8453-OL. See the Tax Due Section below.

Name and Address

2. If you are filing using the AR1000DC or AR1000RC5, claiming

a credit for taxes paid to another state, or filing any other schedule

If you received a mailing label from the State of Arkansas, place

along with your W-2’s, mail your AR8453-OL to:

the label in the name area. Cross out any errors and print the

correct information. Add any missing items, such as apartment

Arkansas Electronic Filing Group

number. If you did not receive a mailing label, print or type the

P. O. Box 8094

information in the spaces provided. Please enter your social

Little Rock, AR 72203-8094

security number(s) (SSN) in the space(s) provided. An incorrect

or missing SSN may delay any refund. If a joint return, be sure the

If you have a tax due return, do not mail your payment with the

names and SSN’s are listed in the same order.

AR8453-OL. See the Tax Due Section below.

If the Post Office does not deliver mail to your home and you have

Notes on special schedules to be attached:

a P. O. Box, enter the box number instead of the home address.

Note: The address must match the address shown on the elec-

If you are claiming an adjustment to income for a permanently

tronically filed form AR1000.

disabled child, please attach the AR1000DC to the back of the

AR8453-OL and mail to address 2.

Part 1 – Tax Return Information

If you are claiming the Other State Tax credit, please attach a copy

of the tax return(s) from each state to the back of the AR8453-OL

Line 3. Include any State of Arkansas withholding from form(s) W-

and mail to address 2.

2 and/or 1099 in the amount you entered on line 3.

If you are claiming a credit for a Developmentally Disabled Child,

All W-2’s and 1099’s must be attached to the AR8453-OL.

please fax a copy of the AR1000RC5 to 501-682-7393. If you do

not have access to a fax, please attach a copy of the form to the

Declaration of Taxpayer

back of the AR8453-OL and mail to address 2.

An electronically transmitted income tax return will not be consid-

Tax Due Information

ered filed, until the State of Arkansas has received a signed form

AR8453-OL with W-2s and/or 1099’s attached. If a joint return,

Do Not attach your check or money order to Form AR8453-OL.

your spouse must also sign.

The AR8453-OL goes to one address and the payment along

with the form AR1000V goes to another.

Refunds

Please mail your payment with Form AR1000-V on or before April

After the State of Arkansas has accepted the electronically filed

15, 2005 to:

return, the refund should be issued within 21 days. However,

some refunds may be temporarily delayed as a result of compli-

State Income Tax – E-File Payment

ance reviews to ensure that the returns are accurate and com-

P. O. Box 8149

plete.

Little Rock, AR 72203-8149

If you do not have the Form AR1000-V, you may get it from your on-

line service provider and/or transmitter. You can also download it

from the State of Arkansas’ Web Site,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2