Worksheet A- Salaries - Wages Tips And Other Compensation - City Of Cincinnati - 2004

ADVERTISEMENT

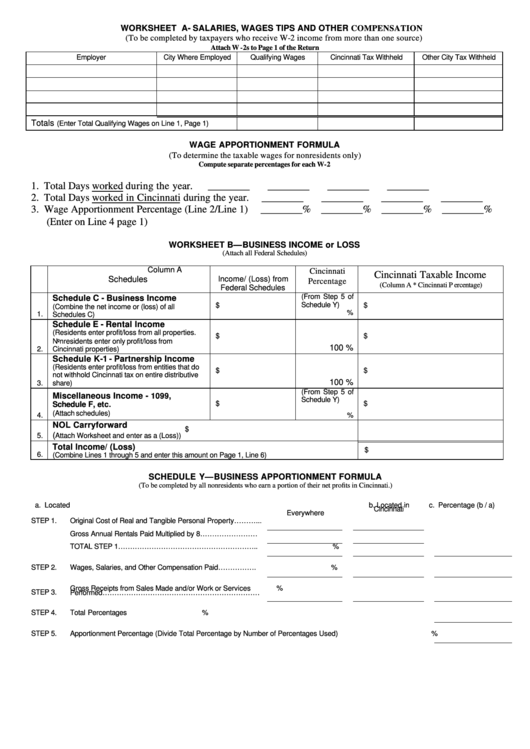

WORKSHEET A- SALARIES, WAGES TIPS AND OTHER COMPENSATION

(To be completed by taxpayers who receive W-2 income from more than one source)

Attach W -2s to Page 1 of the Return

Employer

City Where Employed

Qualifying Wages

Cincinnati Tax Withheld

Other City Tax Withheld

Totals

(Enter Total Qualifying Wages on Line 1, Page 1)

WAGE APPORTIONMENT FORMULA

(To determine the taxable wages for nonresidents only)

Compute separate percentages for each W-2

1. Total Days worked during the year.

________

________

________

________

2. Total Days worked in Cincinnati during the year.

________

________

________

________

3. Wage Apportionment Percentage (Line 2/Line 1)

________% ________% ________% ________%

(Enter on Line 4 page 1)

WORKSHEET B—BUSINESS INCOME or LOSS

(Attach all Federal Schedules)

Column A

Cincinnati

Cincinnati Taxable Income

Income/ (Loss) from

Schedules

Percentage

(Column A * Cincinnati P ercentage)

Federal Schedules

(From Step 5 of

Schedule C - Business Income

Schedule Y)

$

$

(Combine the net income or (loss) of all

%

1.

Schedules C)

Schedule E - Rental Income

(Residents enter profit/loss from all properties.

$

$

Nonresidents enter only profit/loss from

100 %

2.

Cincinnati properties)

Schedule K-1 - Partnership Income

(Residents enter profit/loss from entities that do

$

$

not withhold Cincinnati tax on entire distributive

100 %

3.

share)

(From Step 5 of

Miscellaneous Income -

1099,

Schedule Y)

$

$

Schedule F, etc.

(Attach schedules)

4.

%

NOL Carryforward

$

(

5.

Attach Worksheet and enter as a (Loss))

Total Income/ (Loss)

$

6.

(Combine Lines 1 through 5 and enter this amount on Page 1, Line 6)

SCHEDULE Y—BUSINESS APPORTIONMENT FORMULA

(To be completed by all nonresidents who earn a portion of their net profits in Cincinnati.)

a. Located

b. Located in

c. Percentage (b / a)

Everywhere

Cincinnati

STEP 1.

Original Cost of Real and Tangible Personal Property………...

Gross Annual Rentals Paid Multiplied by 8……………………

TOTAL STEP 1…………………………………………………..

%

STEP 2.

Wages, Salaries, and Other Compensation Paid…………….

%

Gross Receipts from Sales Made and/or Work or Services

STEP 3.

%

Performed…………………………………………………………

STEP 4.

Total Percentages

%

STEP 5.

Apportionment Percentage (Divide Total Percentage by Number of Percentages Used)

%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3