Instructions & Worksheet For Forms Jd-1 And Jq-1 - City Of Akron - State Of Ohio - 2010

ADVERTISEMENT

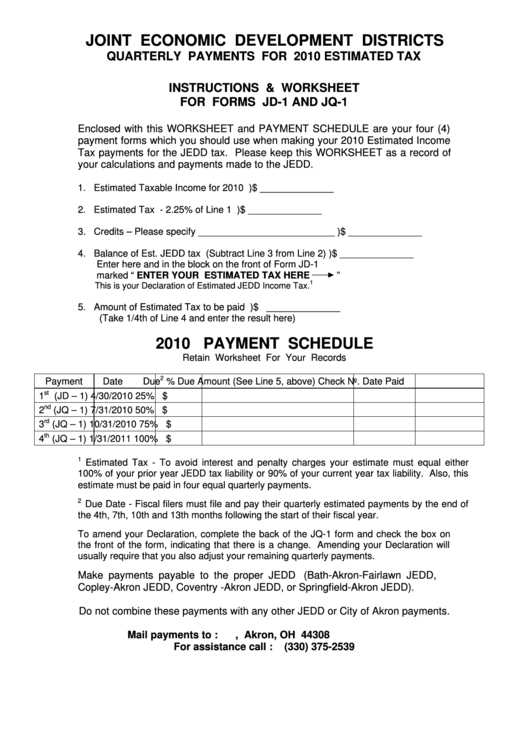

JOINT ECONOMIC DEVELOPMENT DISTRICTS

QUARTERLY PAYMENTS FOR 2010 ESTIMATED TAX

INSTRUCTIONS & WORKSHEET

FOR FORMS JD-1 AND JQ-1

Enclosed with this WORKSHEET and PAYMENT SCHEDULE are your four (4)

payment forms which you should use when making your 2010 Estimated Income

Tax payments for the JEDD tax. Please keep this WORKSHEET as a record of

your calculations and payments made to the JEDD.

1. Estimated Taxable Income for 2010 .......................................1)$ ______________

2. Estimated Tax - 2.25% of Line 1 ............................................2)$ ______________

3. Credits – Please specify __________________________......3)$ ______________

4. Balance of Est. JEDD tax (Subtract Line 3 from Line 2) .........4)$ ______________

Enter here and in the block on the front of Form JD-1

marked “ ENTER YOUR ESTIMATED TAX HERE

”

1

This is your Declaration of Estimated JEDD Income Tax.

5. Amount of Estimated Tax to be paid quarterly .........................5)$ ______________

(Take 1/4th of Line 4 and enter the result here)

2010 PAYMENT SCHEDULE

Retain Worksheet For Your Records

2

Payment

Date Due

% Due

Amount (See Line 5, above)

Check No.

Date Paid

st

1

(JD – 1)

4/30/2010

25%

$

nd

2

(JQ – 1)

7/31/2010

50%

$

rd

3

(JQ – 1)

10/31/2010

75%

$

th

4

(JQ – 1)

1/31/2011

100%

$

1

Estimated Tax - To avoid interest and penalty charges your estimate must equal either

100% of your prior year JEDD tax liability or 90% of your current year tax liability. Also, this

.

estimate must be paid in four equal quarterly payments

2

Due Date - Fiscal filers must file and pay their quarterly estimated payments by the end of

the 4th, 7th, 10th and 13th months following the start of their fiscal year.

To amend your Declaration, complete the back of the JQ-1 form and check the box on

the front of the form, indicating that there is a change. Amending your Declaration will

usually require that you also adjust your remaining quarterly payments.

Make payments payable to the proper JEDD .... (Bath-Akron-Fairlawn JEDD,

Copley-Akron JEDD, Coventry -Akron JEDD, or Springfield-Akron JEDD).

Do not combine these payments with any other JEDD or City of Akron payments.

Mail payments to :

P.O. Box 80538, Akron, OH 44308

For assistance call :

(330) 375-2539

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1