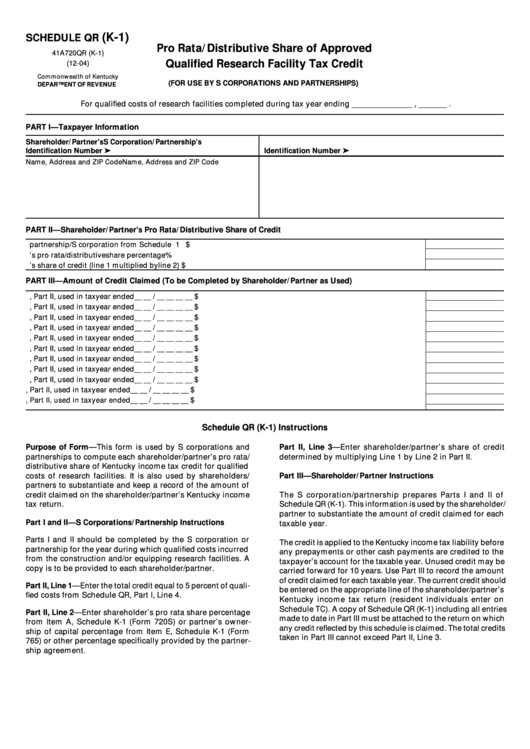

Schedule Qr (K-1) (Form 41a720qr) - Pro Rata/distributive Share Of Approved Qualified Research Facility Tax Credit

ADVERTISEMENT

(K-1)

SCHEDULE QR

Pro Rata/Distributive Share of Approved

41A720QR (K-1)

Qualified Research Facility Tax Credit

(12-04)

Commonwealth of Kentucky

(FOR USE BY S CORPORATIONS AND PARTNERSHIPS)

DEPARTMENT OF REVENUE

For qualified costs of research facilities completed during tax year ending _______________ , _______ .

PART I—Taxpayer Information

Shareholder/Partner’s

S Corporation/Partnership’s

Identification Number

Identification Number

Name, Address and ZIP Code

Name, Address and ZIP Code

PART II—Shareholder/Partner’s Pro Rata/Distributive Share of Credit

1. Total qualified research tax credit of partnership/S corporation from Schedule QR ............................................ 1 $

2. Shareholder/partner’s pro rata/distributive share percentage ................................................................................ 2

%

3. Shareholder/partner’s share of credit (line 1 multiplied by line 2) ......................................................................... 3 $

PART III—Amount of Credit Claimed (To be Completed by Shareholder/Partner as Used)

1. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

2. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

3. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

4. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

5. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

6. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

7. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

8. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

9. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

10. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

11. Amount from line 3, Part II, used in tax year ended __ __ / __ __ __ __ ...................................................................

$

Schedule QR (K-1) Instructions

Purpose of Form—This form is used by S corporations and

Part II, Line 3—Enter shareholder/partner’s share of credit

partnerships to compute each shareholder/partner’s pro rata/

determined by multiplying Line 1 by Line 2 in Part II.

distributive share of Kentucky income tax credit for qualified

costs of research facilities. It is also used by shareholders/

Part III—Shareholder/Partner Instructions

partners to substantiate and keep a record of the amount of

credit claimed on the shareholder/partner’s Kentucky income

The S corporation/partnership prepares Parts I and II of

tax return.

Schedule QR (K-1). This information is used by the shareholder/

partner to substantiate the amount of credit claimed for each

Part I and II—S Corporations/Partnership Instructions

taxable year.

Parts I and II should be completed by the S corporation or

The credit is applied to the Kentucky income tax liability before

partnership for the year during which qualified costs incurred

any prepayments or other cash payments are credited to the

from the construction and/or equipping research facilities. A

taxpayer’s account for the taxable year. Unused credit may be

copy is to be provided to each shareholder/partner.

carried forward for 10 years. Use Part III to record the amount

of credit claimed for each taxable year. The current credit should

Part II, Line 1—Enter the total credit equal to 5 percent of quali-

be entered on the appropriate line of the shareholder/partner’s

fied costs from Schedule QR, Part I, Line 4.

Kentucky income tax return (resident individuals enter on

Schedule TC). A copy of Schedule QR (K-1) including all entries

Part II, Line 2—Enter shareholder’s pro rata share percentage

made to date in Part III must be attached to the return on which

from Item A, Schedule K-1 (Form 720S) or partner’s owner-

any credit reflected by this schedule is claimed. The total credits

ship of capital percentage from Item E, Schedule K-1 (Form

taken in Part III cannot exceed Part II, Line 3.

765) or other percentage specifically provided by the partner-

ship agreement.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1