Schedule Qr - Qualified Research Facility Tax Credit

ADVERTISEMENT

*0600010227*

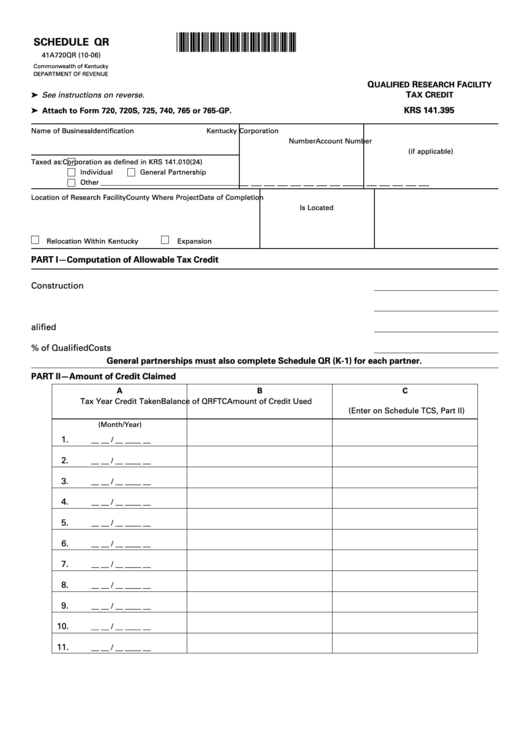

SCHEDULE QR

41A720QR (10-06)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Q

R

F

UALIFIED

ESEARCH

ACILITY

➤ See instructions on reverse.

T

C

AX

REDIT

➤ Attach to Form 720, 720S, 725, 740, 765 or 765-GP.

KRS 141.395

Name of Business

Identification

Kentucky Corporation

Number

Account Number

(if applicable)

Taxed as:

Corporation as defined in KRS 141.010(24)

Individual

General Partnership

__ __ __ __ __ __ __ __ __

__ __ __ __ __ __

Other _______________________________________

Location of Research Facility

County Where Project

Date of Completion

Is Located

Relocation Within Kentucky

Expansion

PART I—Computation of Allowable Tax Credit

1. Cost of Construction .................................................................................................

2. Cost of Equipment .....................................................................................................

3. Total Qualified Costs .................................................................................................

4. Allowable Credit Equal to 5% of Qualified Costs ....................................................

General partnerships must also complete Schedule QR (K-1) for each partner.

PART II—Amount of Credit Claimed

A

B

C

Tax Year Credit Taken

Balance of QRFTC

Amount of Credit Used

(Enter on Schedule TCS, Part II)

(Month/Year)

1.

__ __ / __ __ __ __

2.

__ __ / __ __ __ __

3.

__ __ / __ __ __ __

4.

__ __ / __ __ __ __

5.

__ __ / __ __ __ __

6.

__ __ / __ __ __ __

7.

__ __ / __ __ __ __

8.

__ __ / __ __ __ __

9.

__ __ / __ __ __ __

10.

__ __ / __ __ __ __

11.

__ __ / __ __ __ __

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1