Instructions For Form E-1 - Employers Return Of License Fee Withheld - City Of Owensboro, Kentucky

ADVERTISEMENT

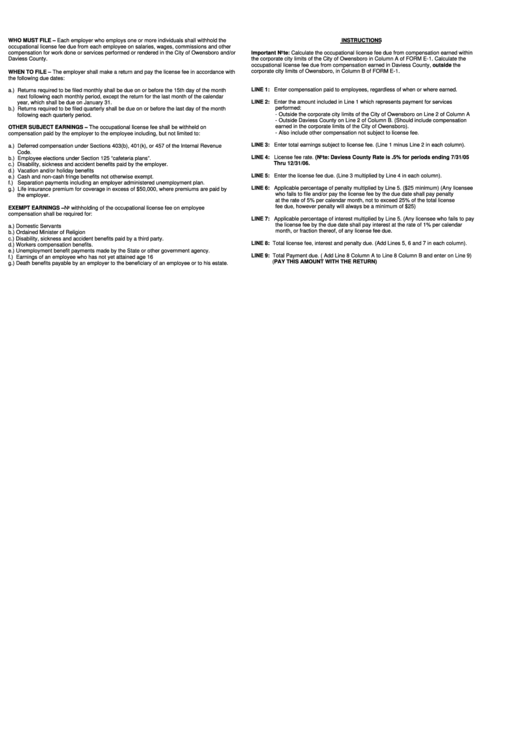

WHO MUST FILE – Each employer who employs one or more individuals shall withhold the

INSTRUCTIONS

occupational license fee due from each employee on salaries, wages, commissions and other

compensation for work done or services performed or rendered in the City of Owensboro and/or

Important Note: Calculate the occupational license fee due from compensation earned within

Daviess County.

the corporate city limits of the City of Owensboro in Column A of FORM E-1. Calculate the

occupational license fee due from compensation earned in Daviess County, outside the

corporate city limits of Owensboro, in Column B of FORM E-1.

WHEN TO FILE – The employer shall make a return and pay the license fee in accordance with

the following due dates:

LINE 1: Enter compensation paid to employees, regardless of when or where earned.

a.) Returns required to be filed monthly shall be due on or before the 15th day of the month

next following each monthly period, except the return for the last month of the calendar

LINE 2: Enter the amount included in Line 1 which represents payment for services

year, which shall be due on January 31.

performed:

b.) Returns required to be filed quarterly shall be due on or before the last day of the month

- Outside the corporate city limits of the City of Owensboro on Line 2 of Column A

following each quarterly period.

- Outside Daviess County on Line 2 of Column B. (Should include compensation

earned in the corporate limits of the City of Owensboro).

OTHER SUBJECT EARNINGS – The occupational license fee shall be withheld on

- Also include other compensation not subject to license fee.

compensation paid by the employer to the employee including, but not limited to:

LINE 3: Enter total earnings subject to license fee. (Line 1 minus Line 2 in each column).

a.) Deferred compensation under Sections 403(b), 401(k), or 457 of the Internal Revenue

Code.

LINE 4: License fee rate. (Note: Daviess County Rate is .5% for periods ending 7/31/05

b.) Employee elections under Section 125 “cafeteria plans”.

Thru 12/31/06.

c.) Disability, sickness and accident benefits paid by the employer.

d.) Vacation and/or holiday benefits

LINE 5: Enter the license fee due. (Line 3 multiplied by Line 4 in each column).

e.) Cash and non-cash fringe benefits not otherwise exempt.

f.) Separation payments including an employer administered unemployment plan.

LINE 6: Applicable percentage of penalty multiplied by Line 5. ($25 minimum) (Any licensee

g.) Life insurance premium for coverage in excess of $50,000, where premiums are paid by

who fails to file and/or pay the license fee by the due date shall pay penalty

the employer.

at the rate of 5% per calendar month, not to exceed 25% of the total license

fee due, however penalty will always be a minimum of $25)

EXEMPT EARNINGS –No withholding of the occupational license fee on employee

compensation shall be required for:

LINE 7: Applicable percentage of interest multiplied by Line 5. (Any licensee who fails to pay

the license fee by the due date shall pay interest at the rate of 1% per calendar

a.) Domestic Servants

month, or fraction thereof, of any license fee due.

b.) Ordained Minister of Religion

c.) Disability, sickness and accident benefits paid by a third party.

LINE 8: Total license fee, interest and penalty due. (Add Lines 5, 6 and 7 in each column).

d.) Workers compensation benefits.

e.) Unemployment benefit payments made by the State or other government agency.

LINE 9: Total Payment due. ( Add Line 8 Column A to Line 8 Column B and enter on Line 9)

f.) Earnings of an employee who has not yet attained age 16

(PAY THIS AMOUNT WITH THE RETURN)

g.) Death benefits payable by an employer to the beneficiary of an employee or to his estate.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1