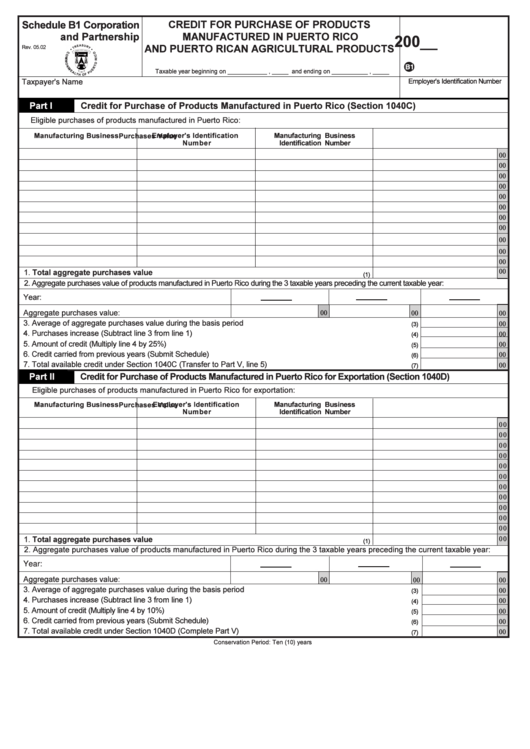

Schedule B1 Corporation And Partnership - Credit For Purchase Of Products Manufactured In Puerto Rico And Puerto Rican Agricultural Products

ADVERTISEMENT

Schedule B1 Corporation

CREDIT FOR PURCHASE OF PRODUCTS

and Partnership

MANUFACTURED IN PUERTO RICO

200__

AND PUERTO RICAN AGRICULTURAL PRODUCTS

Rev. 05.02

B1

Taxable year beginning on ____________ , _____ and ending on ___________ , _____

Taxpayer's Name

Employer's Identification Number

Part I

Credit for Purchase of Products Manufactured in Puerto Rico (Section 1040C)

Eligible purchases of products manufactured in Puerto Rico:

Manufacturing Business

Employer's Identification

Manufacturing Business

Purchases Value

Number

Identification Number

00

00

00

00

00

00

00

00

00

00

00

00

1. Total aggregate purchases value .....................................................................................................

(1)

2. Aggregate purchases value of products manufactured in Puerto Rico during the 3 taxable years preceding the current taxable year:

Year:

Aggregate purchases value:

00

00

00

3. Average of aggregate purchases value during the basis period ..................................................................................

00

(3)

4. Purchases increase (Subtract line 3 from line 1) ..........................................................................................................

00

(4)

5. Amount of credit (Multiply line 4 by 25%) .........................................................................................................................

00

(5)

6. Credit carried from previous years (Submit Schedule) ....................................................................................................

00

(6)

7. Total available credit under Section 1040C (Transfer to Part V, line 5) ........................................................................

00

(7)

Part II

Credit for Purchase of Products Manufactured in Puerto Rico for Exportation (Section 1040D)

Eligible purchases of products manufactured in Puerto Rico for exportation:

Manufacturing Business

Manufacturing Business

Employer's Identification

Purchases Value

Identification Number

Number

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

1. Total aggregate purchases value .....................................................................................................

(1)

2. Aggregate purchases value of products manufactured in Puerto Rico during the 3 taxable years preceding the current taxable year:

Year:

Aggregate purchases value:

00

00

00

3. Average of aggregate purchases value during the basis period ................................................................................

00

(3)

4. Purchases increase (Subtract line 3 from line 1) ..........................................................................................................

00

(4)

5. Amount of credit (Multiply line 4 by 10%) ............................................................................................................................

00

(5)

6. Credit carried from previous years (Submit Schedule) ....................................................................................................

00

(6)

7. Total available credit under Section 1040D (Complete Part V).....................................................................................

00

(7)

Conservation Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2