State of New Jersey

D

T

EPARTMENT OF THE

REASURY

D

T

IVISION OF

AXATION

PO B

269

OX

Please respond to:

T

NJ 08695-0269

RENTON

Customer Service Center

(609) 292-6400

Businesses that do not sell taxable goods or services or lease taxable property to others are considered “nonsellers” and

are not required to file sales and use tax returns (Forms ST-50/51) on a quarterly/monthly basis. Although nonsellers do not

collect sales tax, they may still need to pay use tax. A business incurs use tax if it purchases taxable property or services

without payment of sales tax, or pays tax at a rate less than New Jersey’s rate of 7%. Nonseller businesses whose average

annual use tax for the last three calendar years is $2,000 or less may file an Annual Business Use Tax Return (Form ST-18B)

to report and pay any use tax that is due instead of filing Forms ST-50/51.

According to our records, this business is registered as a nonseller and may be eligible to use Form ST-18B. If your

average annual use tax for 2008, 2009, and 2010 is $2,000 or less, complete the form below to report any use tax due on

business purchases made from January 1, 2011, through December 31, 2011. Form ST-18B is due on or before May 1, 2012.

You are not required to file an ST-18B for any calendar year in which you do not owe any use tax.

If your business sells taxable goods or services or leases taxable property to others, or if your average annual use tax

liability for the last three calendar years was more than $2,000, you may not file Form ST-18B. You must change your

business registration to include sales tax eligibility and must begin to file quarterly/monthly sales and use tax returns. To add

sales tax eligibility visit the Division of Revenue’s New Jersey Business Gateway Registry Services at:

Changes can be made through the Online Registration Change Service or by completing

and mailing Form REG-C-L.

Remember, do not use Form ST-18B for 2011 if:

• Your business sells taxable goods or services or leases taxable property to others, or

• Your average annual use tax for 2008, 2009, and 2010 is more than $2,000, or

• You do not owe use tax for 2011.

More information is available in publication ANJ-7, Use Tax in New Jersey, Tax Topic Bulletin S&U-7, Filing Sales

and Use Tax Returns, and on the Division of Taxation’s Web site at:

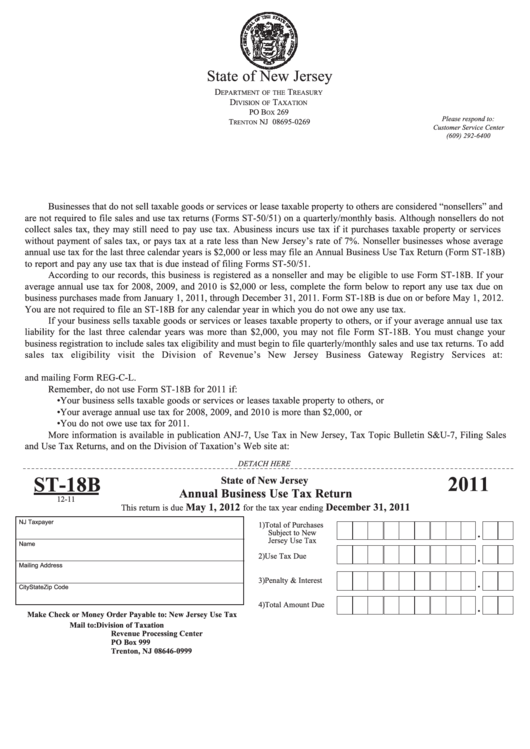

DETACH HERE

State of New Jersey

ST-18B

2011

Annual Business Use Tax Return

12-11

May 1, 2012

December 31, 2011

This return is due

for the tax year ending

NJ Taxpayer I.D. Number

1) Total of Purchases

.

Subject to New

Jersey Use Tax

Name

.

2) Use Tax Due

Mailing Address

.

3) Penalty & Interest

City

State

Zip Code

.

4) Total Amount Due

Make Check or Money Order Payable to: New Jersey Use Tax

Mail to:

Division of Taxation

Revenue Processing Center

PO Box 999

Trenton, NJ 08646-0999

1

1 2

2