State of New Jersey

D

T

EPARTMENT OF THE

REASURY

D

T

IVISION OF

AXATION

PO B

269

OX

T

NJ 08695-0269

RENTON

Please respond to:

Customer Service Center

(609) 292-6400

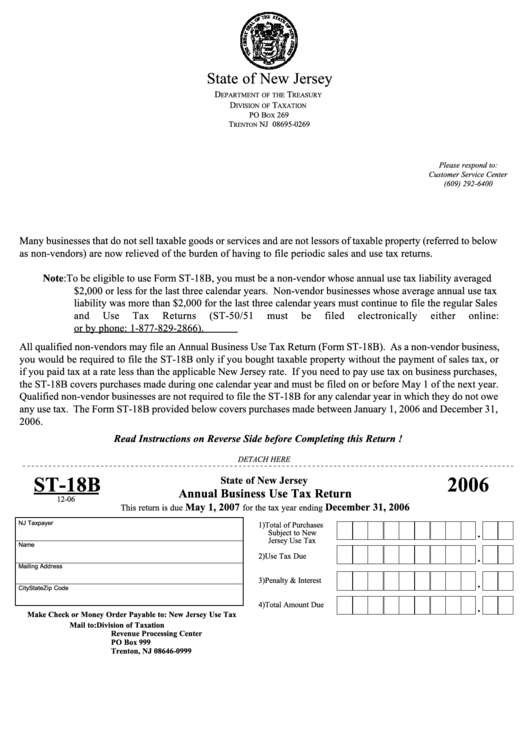

Many businesses that do not sell taxable goods or services and are not lessors of taxable property (referred to below

as non-vendors) are now relieved of the burden of having to file periodic sales and use tax returns.

Note: To be eligible to use Form ST-18B, you must be a non-vendor whose annual use tax liability averaged

$2,000 or less for the last three calendar years. Non-vendor businesses whose average annual use tax

liability was more than $2,000 for the last three calendar years must continue to file the regular Sales

and

Use

Tax

Returns

(ST-50/51

must

be

filed

electronically

either

online:

or by phone: 1-877-829-2866).

All qualified non-vendors may file an Annual Business Use Tax Return (Form ST-18B). As a non-vendor business,

you would be required to file the ST-18B only if you bought taxable property without the payment of sales tax, or

if you paid tax at a rate less than the applicable New Jersey rate. If you need to pay use tax on business purchases,

the ST-18B covers purchases made during one calendar year and must be filed on or before May 1 of the next year.

Qualified non-vendor businesses are not required to file the ST-18B for any calendar year in which they do not owe

any use tax. The Form ST-18B provided below covers purchases made between January 1, 2006 and December 31,

2006.

Read Instructions on Reverse Side before Completing this Return !

DETACH HERE

ST-18B

2006

State of New Jersey

Annual Business Use Tax Return

12-06

May 1, 2007

December 31, 2006

This return is due

for the tax year ending

NJ Taxpayer I.D. Number

1) Total of Purchases

.

Subject to New

Jersey Use Tax

Name

.

2) Use Tax Due

Mailing Address

.

3) Penalty & Interest

City

State

Zip Code

.

4) Total Amount Due

Make Check or Money Order Payable to: New Jersey Use Tax

Mail to:

Division of Taxation

Revenue Processing Center

PO Box 999

Trenton, NJ 08646-0999

1

1 2

2