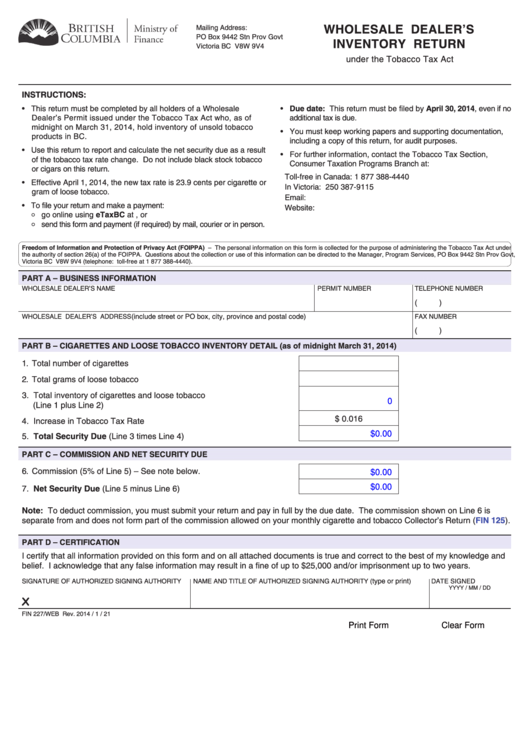

wholesale dealer’s

Mailing Address:

PO Box 9442 Stn Prov Govt

inventory return

Victoria BC V8W 9V4

gov.bc.ca/consumertaxes

under the Tobacco Tax Act

instruCtions:

• This return must be completed by all holders of a Wholesale

• due date: This return must be filed by april 30, 2014, even if no

Dealer’s Permit issued under the Tobacco Tax Act who, as of

additional tax is due.

midnight on March 31, 2014, hold inventory of unsold tobacco

• You must keep working papers and supporting documentation,

products in BC.

including a copy of this return, for audit purposes.

• Use this return to report and calculate the net security due as a result

• For further information, contact the Tobacco Tax Section,

of the tobacco tax rate change. Do not include black stock tobacco

Consumer Taxation Programs Branch at:

or cigars on this return.

Toll-free in Canada: 1 877 388-4440

• Effective April 1, 2014, the new tax rate is 23.9 cents per cigarette or

In Victoria: 250 387-9115

gram of loose tobacco.

Email:

tobaccotax@gov.bc.ca

• To file your return and make a payment:

gov.bc.ca/consumertaxes

Website:

go online using etaxBC at gov.bc.ca/etaxbc/myaccount, or

š

send this form and payment (if required) by mail, courier or in person.

š

Freedom of Information and Protection of Privacy Act (FOIPPA) – The personal information on this form is collected for the purpose of administering the Tobacco Tax Act under

the authority of section 26(a) of the FOIPPA. Questions about the collection or use of this information can be directed to the Manager, Program Services, PO Box 9442 Stn Prov Govt,

Victoria BC V8W 9V4 (telephone: toll-free at 1 877 388-4440).

part a – Business information

WholESAlE dEAlER’S NAmE

pERmIT NUmBER

TElEphoNE NUmBER

(

)

(include street or PO box, city, province and postal code)

WholESAlE dEAlER’S AddRESS

FAx NUmBER

(

)

part B – Cigarettes and loose toBaCCo inventory detail (as of midnight March 31, 2014)

1. Total number of cigarettes

2. Total grams of loose tobacco

3. Total inventory of cigarettes and loose tobacco

0

(Line 1 plus Line 2)

$ 0.016

4. Increase in Tobacco Tax Rate

$0.00

5. total security due (Line 3 times Line 4)

part C – Commission and net seCurity due

6. Commission (5% of Line 5) – See note below.

$0.00

7. net security due (Line 5 minus Line 6)

$0.00

note: To deduct commission, you must submit your return and pay in full by the due date. The commission shown on Line 6 is

separate from and does not form part of the commission allowed on your monthly cigarette and tobacco Collector’s Return

(fin

125).

part d – CertifiCation

I certify that all information provided on this form and on all attached documents is true and correct to the best of my knowledge and

belief. I acknowledge that any false information may result in a fine of up to $25,000 and/or imprisonment up to two years.

type or print

SIGNATURE oF AUThoRIzEd SIGNING AUThoRITY

NAmE ANd TITlE oF AUThoRIzEd SIGNING AUThoRITY (

)

DATE SIGNED

YYYY / mm / dd

X

FIN 227/WEB Rev. 2014 / 1 / 21

Print Form

Clear Form

1

1