Grocery Credit Worksheet, Form 40 - Idaho Individual Income Tax Return - 2010

ADVERTISEMENT

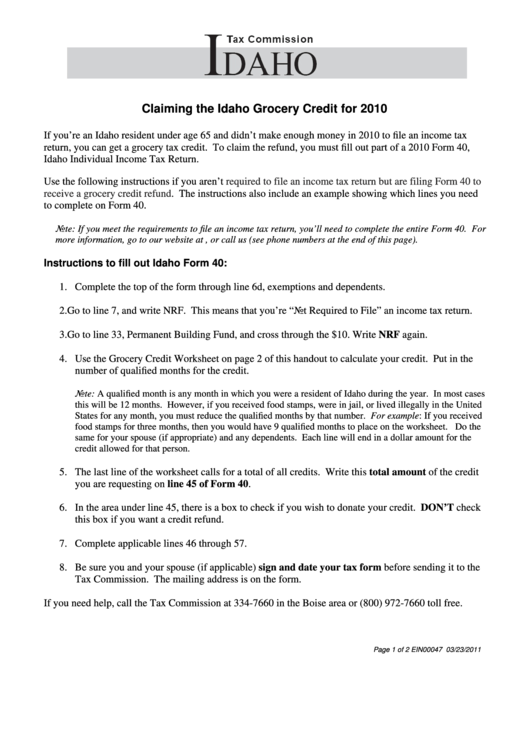

Claiming the Idaho Grocery Credit for 2010

If you’re an Idaho resident under age 65 and didn’t make enough money in 2010 to file an income tax

return, you can get a grocery tax credit. To claim the refund, you must fill out part of a 2010 Form 40,

Idaho Individual Income Tax Return.

Use the following instructions if you aren’t

required to file an income tax return but are filing Form 40 to

receive a grocery credit

refund. The instructions also include an example showing which lines you need

to complete on Form 40.

Note: If you meet the requirements to file an income tax return, you’ll need to complete the entire Form 40. For

more information, go to our website at tax.idaho.gov, or call us (see phone numbers at the end of this page).

Instructions to fill out Idaho Form 40:

1. Complete the top of the form through line 6d, exemptions and dependents.

2. Go to line 7, and write NRF. This means that you’re “Not Required to File” an income tax return.

3. Go to line 33, Permanent Building Fund, and cross through the $10. Write NRF again.

4. Use the Grocery Credit Worksheet on page 2 of this handout to calculate your credit. Put in the

number of qualified months for the credit.

Note: A qualified month is any month in which you were a resident of Idaho during the year. In most cases

this will be 12 months. However, if you received food stamps, were in jail, or lived illegally in the United

States for any month, you must reduce the qualified months by that number. For example: If you received

food stamps for three months, then you would have 9 qualified months to place on the worksheet. Do the

same for your spouse (if appropriate) and any dependents. Each line will end in a dollar amount for the

credit allowed for that person.

5. The last line of the worksheet calls for a total of all credits. Write this total amount of the credit

you are requesting on line 45 of Form 40.

6. In the area under line 45, there is a box to check if you wish to donate your credit. DON’T check

this box if you want a credit refund.

7. Complete applicable lines 46 through 57.

8. Be sure you and your spouse (if applicable) sign and date your tax form before sending it to the

Tax Commission. The mailing address is on the form.

If you need help, call the Tax Commission at 334-7660 in the Boise area or (800) 972-7660 toll free.

Page 1 of 2 EIN00047 03/23/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4