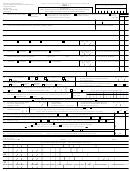

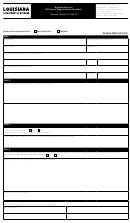

R-1022 (12/16)

Information for Application for Offshore Registration Number

Louisiana Revised Statute 47:305.10 allows for tax-free purchases or importations of property for first use in the offshore area of

Louisiana or any other state, even if the specific location of first use is not known at the time of purchase. Revenue Information

Bulletin No 16-034 clarifies that items purchased for use in an offshore area beyond the territorial limits of Louisiana are not

subject to tax pursuant to R.S. 47:305(E) and therefore not subject to the suspension of exemptions under Act 25 of the 1st

Extraordinary Session of 2016.

Certain restrictions and requirements are imposed on the purchaser or importer of tax-free goods under these provisions. The

purchaser must first request and obtain from the Secretary of Revenue an “Offshore Registration Number” by providing all

information required on this application. If approved, the applicant will be issued a new sales tax registration certificate with the

proper “offshore” designation thereon. Applicants who do not have a sales tax registration certificate must apply online at

www.

revenue.louisiana.gov/Businesses/BusinessRegistration

or submit Form R-16019, (CR-1), Application for Louisiana Tax Number,

along with the offshore number application.

The offshore registration number will only be issued to applicants who consume tangible personal property in the offshore area

on a regular basis, and have a definite need for the privilege of purchasing tax free for offshore use.

The most rigid requirement for obtaining and keeping the “Offshore Registration Number” status is the record keeping requirement.

Records must be maintained and kept to reflect accurately the location of ultimate use of property which is purchased tax free.

They must be easily accessible and readily available for examination by the Department.

The exemption provided under these provisions applies only to tangible personal property purchased for use in the offshore area.

It does not apply to purchases for which the location of use is known to be within the taxing jurisdiction of Louisiana or another

state or country. Property purchased tax free under this exemption must be accounted for by separate inventory records to prevent

the withdrawal of tax-free goods from the commingled inventory for use in taxable areas. Fungible goods, due to their “continuous

consumption” nature, may be purchased tax free for use in both taxable and nontaxable locations. The proper accrual entries must

then be made each reporting period to record the taxes due for the portion that is determined to have been consumed within the

taxing jurisdiction of Louisiana or any other state. Purchases of tangible personal property for use offshore in specifically known

locations must be made through the issuance of exemption certificate Form R-1096, (LGST-9D), Offshore Purchases Certificate.

Tangible personal property purchased tax-free under these provisions may be stored indefinitely, until such time that it is needed

at a particular location. Property may also be returned to the offshore inventory following use in the offshore area, provided that

use does not occur within Louisiana or another state during its return to inventory. Property may also be returned to Louisiana or

another state for repairs, modification or refabrication without incurring any use tax liability. The repair charges, however, will be

subject to the sales tax at the applicable rate.

An offshore registration number may be revoked by the Department for misuse, failure to retain adequate accounting records, or

failure to accrue and remit the taxes that become due on taxable uses of withdrawn property. Upon such revocation, use tax will

be immediately due on all property remaining in the offshore inventory in addition to any other tax deficiencies that an examination

may reveal. It will then be the burden of the purchaser to prove to the satisfaction of the Department that the deficiencies which

led to the misuse, lack of documents, or failure to remit, have been corrected and that the offshore registration number privilege

should be restored.

1

1 2

2