Form 500e - Virginia Corporate Income Tax Extension Payment Voucher And Tentative Tax Return

ADVERTISEMENT

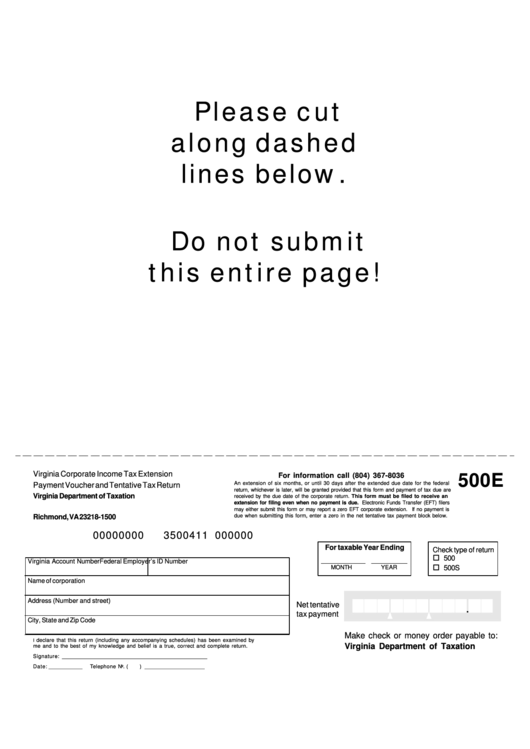

Please cut

along dashed

lines below.

Do not submit

this entire page!

Virginia Corporate Income Tax Extension

For information call (804) 367-8036

500E

An extension of six months, or until 30 days after the extended due date for the federal

Payment Voucher and Tentative Tax Return

return, whichever is later, will be granted provided that this form and payment of tax due are

Virginia Department of Taxation

received by the due date of the corporate return. This form must be filed to receive an

extension for filing even when no payment is due. Electronic Funds Transfer (EFT) filers

P.O. Box 1500

may either submit this form or may report a zero EFT corporate extension.

If no payment is

due when submitting this form, enter a zero in the net tentative tax payment block below.

Richmond, VA 23218-1500

00000000

3500411 000000

For taxable Year Ending

Check type of return

o

500

Virginia Account Number

Federal Employer’s ID Number

o

MONTH

YEAR

500S

Name of corporation

Address (Number and street)

Net tentative

.

tax payment

City , State and Zip Code

Make check or money order payable to:

declare that this return (including any accompanying schedules) has been examined by

I

Virginia Department of Taxation

me and to the best of my knowledge and belief is a true, correct and complete return.

Signature: _______________________________________________________

Date: _____________

Telephone No . (

) _______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1