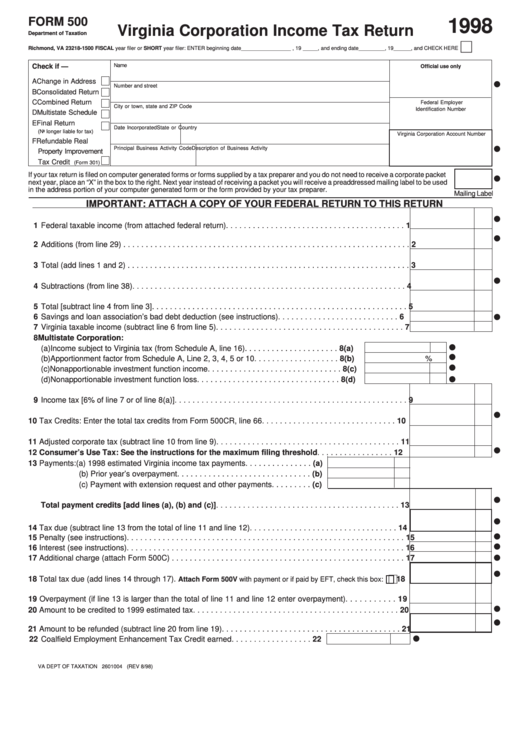

FORM 500

1998

Virginia Corporation Income Tax Return

Department of Taxation

P.O. Box 1500

Richmond, VA 23218-1500

FISCAL year filer or SHORT year filer: ENTER beginning date _________________ , 19 _____ , and ending date _________ , 19 ______ , and CHECK HERE

Name

Check if —

Official use only

A Change in Address

Number and street

B Consolidated Return

C Combined Return

Federal Employer

City or town, state and ZIP Code

Identification Number

D Multistate Schedule

E Final Return

Date Incorporated

State or Country

(No longer liable for tax)

Virginia Corporation Account Number

F Refundable Real

Principal Business Activity Code

Description of Business Activity

Property Improvement

Tax Credit

(Form 301)

If your tax return is filed on computer generated forms or forms supplied by a tax preparer and you do not need to receive a corporate packet

next year, place an “X” in the box to the right. Next year instead of receiving a packet you will receive a preaddressed mailing label to be used

in the address portion of your computer generated form or the form provided by your tax preparer.

Mailing Label

IMPORTANT: ATTACH A COPY OF YOUR FEDERAL RETURN TO THIS RETURN

1 Federal taxable income (from attached federal return) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Additions (from line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Total (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Subtractions (from line 38) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Total [subtract line 4 from line 3] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Savings and loan association’s bad debt deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Virginia taxable income (subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Multistate Corporation:

(a) Income subject to Virginia tax (from Schedule A, line 16) . . . . . . . . . . . . . . . . . . . . . 8(a)

(b) Apportionment factor from Schedule A, Line 2, 3, 4, 5 or 10 . . . . . . . . . . . . . . . . . . . 8(b)

%

(c) Nonapportionable investment function income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8(c)

(d) Nonapportionable investment function loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8(d)

9 Income tax [6% of line 7 or of line 8(a)] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Tax Credits: Enter the total tax credits from Form 500CR, line 66 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Adjusted corporate tax (subtract line 10 from line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Consumer’s Use Tax: See the instructions for the maximum filing threshold . . . . . . . . . . . . . . . . . 12

13 Payments: (a) 1998 estimated Virginia income tax payments . . . . . . . . . . . . . . . (a)

(b) Prior year’s overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (b)

(c) Payment with extension request and other payments . . . . . . . . . (c)

Total payment credits [add lines (a), (b) and (c)] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Tax due (subtract line 13 from the total of line 11 and line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Additional charge (attach Form 500C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Total tax due (add lines 14 through 17).

18

Attach Form 500V with payment or if paid by EFT, check this box:

19 Overpayment (if line 13 is larger than the total of line 11 and line 12 enter overpayment) . . . . . . . . . . . 19

20 Amount to be credited to 1999 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Amount to be refunded (subtract line 20 from line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Coalfield Employment Enhancement Tax Credit earned . . . . . . . . . . . . . . . . . . 22

VA DEPT OF TAXATION 2601004 (REV 8/98)

1

1 2

2